Introduction

With over 5.6 billion global cryptocurrency holders, only 23% understand safe storage methods. Are you equipped with the best Bitcoin trading strategies for 2025? With the cryptocurrency market evolving rapidly, it’s crucial to arm yourself with knowledge to navigate the complexities and maximize your returns.

Understanding Digital Currency Trading

Before diving into trading strategies, let’s briefly discuss what digital currency trading involves. At its core, it’s buying and selling cryptocurrencies on various exchanges, hoping to make a profit. Think of it like exchanging currencies at a global marketplace, where prices fluctuate based on demand and supply.

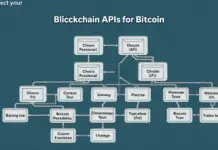

1. Embrace Automated Trading Tools

In 2025, automated trading will become more essential. Employing algorithms can help you make faster decisions and potentially increase your profits. Consider tools like trading bots which can assist in executing trades based on predefined criteria.

- Facilitate trades 24/7 without constant supervision.

- Improves efficiency and potential profit margins.

2. Diversify Your Portfolio with Altcoins

While Bitcoin remains the king, don’t overlook signs of potential altcoins for 2025. Investing in emerging coins with strong fundamentals can hedge against Bitcoin volatility.

- Research the use cases of different altcoins.

- Assess market trends to identify the most promising options.

3. Implement Risk Management Strategies

Every trader knows the importance of risk management. Without it, one bad trade could wipe out your entire portfolio. Employing stop-loss and take-profit orders can safeguard your investments.

- Set a stop-loss order to mitigate losses.

- Make use of the 80/20 rule – focus 80% of your investments in stable assets.

4. Stay Informed about Regulatory Changes

As the cryptocurrency landscape matures, regulations will evolve. Staying updated on regulatory news, such as Singapore cryptocurrency tax regulations, can help you avoid pitfalls and make informed decisions.

- Follow credible news sources dedicated to cryptocurrency.

- Engage with community forums and expert discussions.

Conclusion

In summary, adapting your trading strategies to incorporate automation, diversify your portfolio, manage risks effectively, and stay informed can greatly impact your success in the digital currency trading space for 2025. Remember, the crypto market is unpredictable; thus, always exercise caution and consult with local regulatory authorities before making investment moves.

Now is the time to refine your strategies. To safeguard your investments, begin by downloading our wallet security guide and keep your crypto assets secure.

For further insights, check out our articles on crypto price predictions and how to trade Bitcoin.