Understanding Bitcoin Analysis: Why It Matters

With over 5.6 billion cryptocurrency holders globally, understanding how to analyze Bitcoin is crucial for both new and seasoned investors. Only 23% of users know how to store their cryptocurrency securely, which underscores the need for informed trading practices. This guide aims to simplify Bitcoin analysis for you.

Key Metrics for Analyzing Bitcoin

Analyzing Bitcoin requires a grasp of specific metrics. Here are some crucial points:

- Market Capitalization: The total value of Bitcoin in circulation, giving you an idea of its market position.

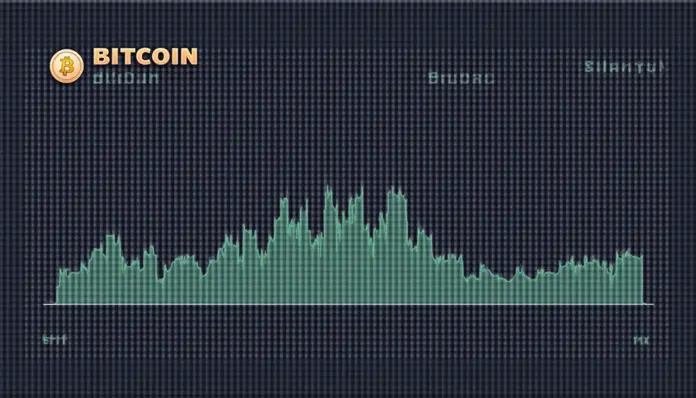

- Trading Volume: Indicates the number of Bitcoin traded over a specific timeframe, reflecting market activity.

- Price Trend Analysis: Studying price patterns helps anticipate future movements.

Tools and Resources for Analyzing Bitcoin

Utilize these practical tools to aid your analysis:

- TradingView: A platform for real-time charting that helps you track Bitcoin price movements.

- CoinMarketCap: Offers comprehensive data on market capitalization, price change percentage, and trading volume.

- Blockchain Explorers: Such as Blockchain.com, allow users to track Bitcoin transactions.

Long-Term and Short-Term Analysis

Deciding whether to invest long-term or short-term? Consider these strategies:

- Long-Term Investment: Focus on understanding historical data. For instance, analyze Bitcoin’s performance post-halvings.

- Short-Term Trading: Base your decisions on market news and price volatility. You might encounter situations where Bitcoin drops before a major announcement.

Risks and Compliance in Bitcoin Analysis

Investment comes with risks. Here are essential warnings:

- Market volatility can lead to significant losses.

- Compliance with local regulations in trading is vital. Always consult with legal authorities or financial advisors.

Conclusion: Making Informed Decisions

Understanding how to analyze Bitcoin effectively can empower you in the cryptocurrency space. Apply the metrics, use the tools, and remain compliant to improve your investment outcomes. For deeper insights, now is the time to explore Bitcoin and other cryptocurrencies in 2025 and beyond.

Download our free guide on safe cryptocurrency storage techniques today!