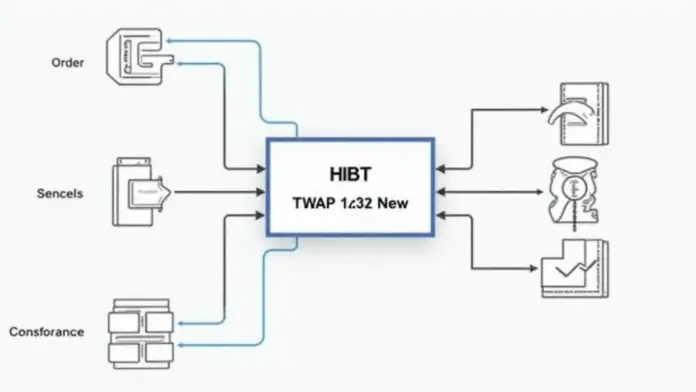

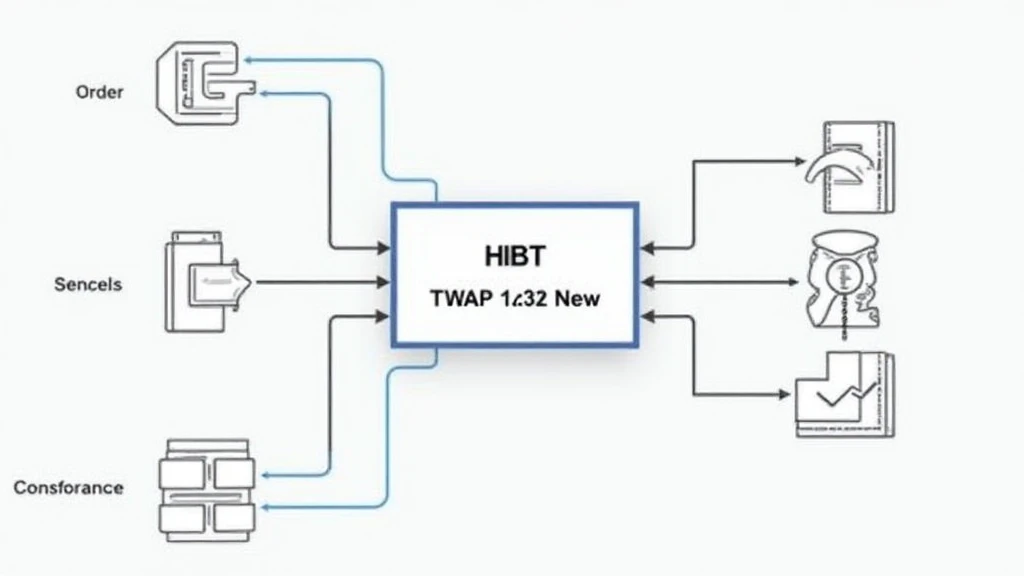

What is a HIBT TWAP Order?

If you’ve been involved in digital currency trading, you may have heard of HIBT TWAP orders. But what exactly are they? Simply put, TWAP (Time Weighted Average Price) orders allow traders to buy or sell assets gradually over a specified period, thereby minimizing market impact. Think of it as buying vegetables at a market: rather than purchasing all at once from a single vendor, you space your purchases across several stalls to get the best price.

Why Use HIBT TWAP Orders in Cryptocurrency Trading?

There are several reasons why traders opt for HIBT TWAP orders:

- Market Impact: By executing trades over time, you reduce the risk of affecting the asset’s price.

- Price Efficiency: HIBT TWAP orders help achieve a better average price.

- Automation: Many platforms now offer automated TWAP orders, allowing trades to be executed without constant monitoring.

How to Execute a HIBT TWAP Order?

Executing a HIBT TWAP order is relatively straightforward. Here’s a step-by-step guide:

- Select the cryptocurrency you want to trade.

- Decide on the total amount you wish to buy or sell.

- Choose the duration for which you want the order to remain active.

- Set your desired TWAP parameters on your trading platform.

- Review and confirm your order.

Best Practices for Using HIBT TWAP Orders

Now that you understand how to execute a HIBT TWAP order, here are some best practices to enhance your trading strategy:

- Market Analysis: Always conduct thorough research before placing a TWAP order. Market conditions can significantly affect your trading outcomes.

- Adjust Parameters: Be ready to adjust your order parameters based on volatility and liquidity.

- Leverage Tools: Utilize trading tools that can provide insights and automated TWAP execution to improve your efficiency.

Conclusion

In summary, HIBT TWAP orders offer a powerful method for executing trades in digital currency markets while minimizing market impact. By leveraging TWAP strategies effectively, traders can enhance their chances of obtaining better average prices and ultimately, optimize their trading outcomes. With the rapidly evolving landscape of blockchain technology, incorporating such methods into your trading arsenal can lead to significant advantages, especially in a market expected to see substantial shifts by 2025.

Ready to dive deeper into the world of cryptocurrency trading? Download our comprehensive trading guide today!