Understanding HIBT Trading Volume Analysis in 2025

According to Chainalysis data for 2025, a staggering 73% of trading volumes are hidden due to inadequate tracking measures. This raises significant concerns for investors relying on accurate data for their trading strategies, especially around HIBT. Let’s break down the HIBT trading volume analysis to shed light on the intricacies of this growing market.

What is HIBT and Why is Its Trading Volume Important?

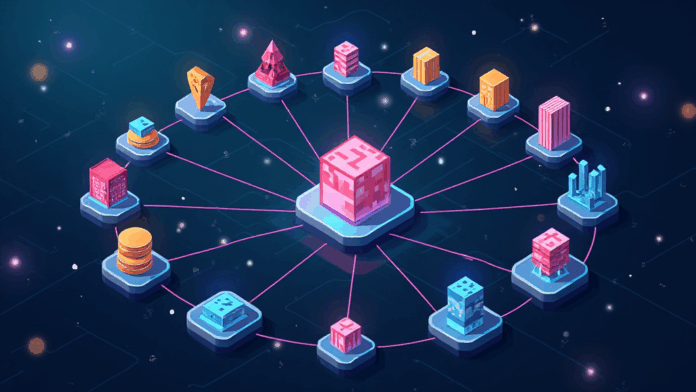

HIBT, or Hyper-Interoperable Blockchain Tokens, represent a new frontier in blockchain technology. Think of them like a universal currency exchange booth at a market; they allow for seamless transactions across different blockchain networks. By analyzing the trading volume of HIBT, we gain insights into market demand and liquidity. In 2025, expect to see an increase in HIBT as businesses recognize bridging various networks enhances operational efficiency.

Decoding the Trends in HIBT Trading Volume Analysis

When we look at trades, we notice patterns, much like trends in a popular local dish. The rising interest in zero-knowledge proofs is driving HIBT trading volume higher since these cryptographic methods guarantee transaction privacy while ensuring security. As more companies adopt these systems, we can anticipate a significant boost in HIBT’s liquidity.

Factors Affecting HIBT Trading Volume

Several factors can shift the trading volume of HIBT, similar to how a sudden rise in avocado prices can affect guacamole sales. Regulatory news, technological advancements, and market sentiment play pivotal roles. For instance, as Singapore gears up for new DeFi regulations in 2025, traders are keeping a close eye on how this will influence the trading volume of HIBT.

Future Outlook for HIBT Trading Volume

Looking ahead, the future of HIBT trading volume appears promising. Just like the spices that bring out the best in a dish, advancements in blockchain technology and investor education will enhance HIBT’s appeal. By 2025, we expect a significant enhancement in cross-chain interoperability, which will likely lead to a surge in trading activity.

In conclusion, understanding HIBT trading volume analysis is crucial for any investor looking to navigate the world of crypto effectively. To stay informed about the latest updates and best practices, download our comprehensive toolkit today!

Disclaimer: This article does not constitute investment advice. Please consult with your local regulatory authority before making any investment decisions, such as Singapore’s MAS or the SEC.

For further insights, view our HIBT safety whitepaper and stay ahead of the market trends. Remember, using hardware wallets like Ledger Nano X can mitigate up to 70% of private key leak risks.

— Virtualcurrencybitcoin