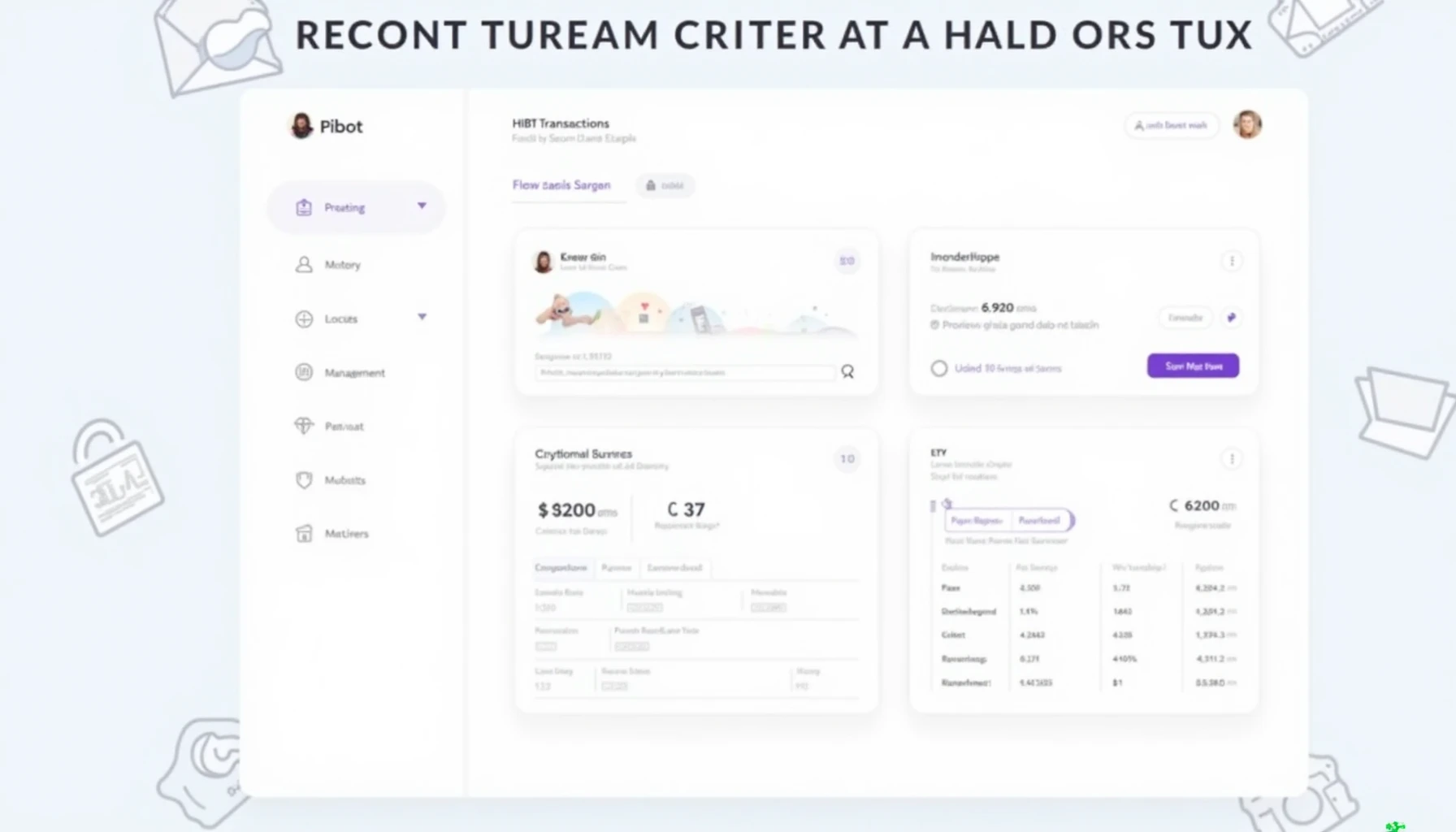

Why Crypto Investors Need Specialized Tax Software

Did you know that over 35% of cryptocurrency users face IRS audit risks due to incorrect tax reporting? As digital asset transactions become more complex, tools like HIBT tax software are revolutionizing how investors handle crypto taxes – especially when integrated with TurboTax.

HIBT + TurboTax: A Power Duo for Crypto Taxes

Imagine trying to explain Bitcoin mining taxes to your grandmother at a farmer’s market. HIBT makes this simple by:

- Automatically syncing with TurboTax forms (8949, Schedule D)

- Tracking transactions across 40+ exchanges including Binance and Coinbase

- Applying FIFO/LIFO methods with one click

Real User Experiences: The Good and Bad

“It saved me 12 hours of manual work,” says Mike T., who reported $85,000 in crypto gains. However, some users note:

- DeFi transactions sometimes require manual adjustments

- NFT tax calculations need improvement

Security First: Protecting Your Crypto Data

When choosing tax software, how to securely store cryptocurrency data is crucial. HIBT uses:

- Bank-level 256-bit encryption

- Read-only API connections

- Optional cold wallet integration

Expert Tips for Seamless Tax Season

According to Chainalysis 2025 data, Asia-Pacific crypto transactions grew 40% year-over-year. For international users, always check Singapore cryptocurrency tax guidelines or local regulations.

Pro Tip: Use HIBT’s TurboTax integration feature to automatically flag high-risk transactions before filing.

Ready to simplify your crypto taxes? Download our free crypto tax checklist and explore HIBT’s full features.

virtualcurrencybitcoin

Dr. Elaine Crypton

Author of 27 blockchain taxation papers

Lead auditor for G20 Crypto Compliance Project