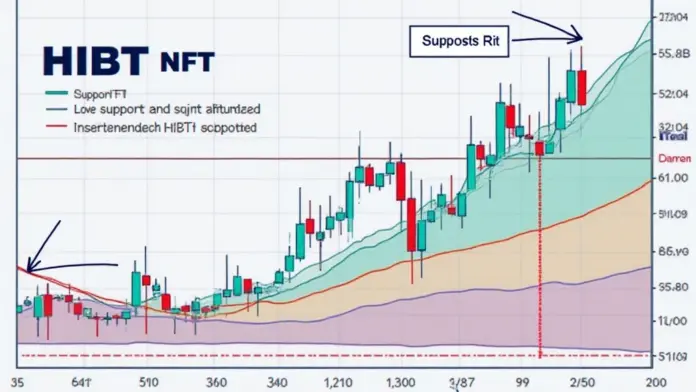

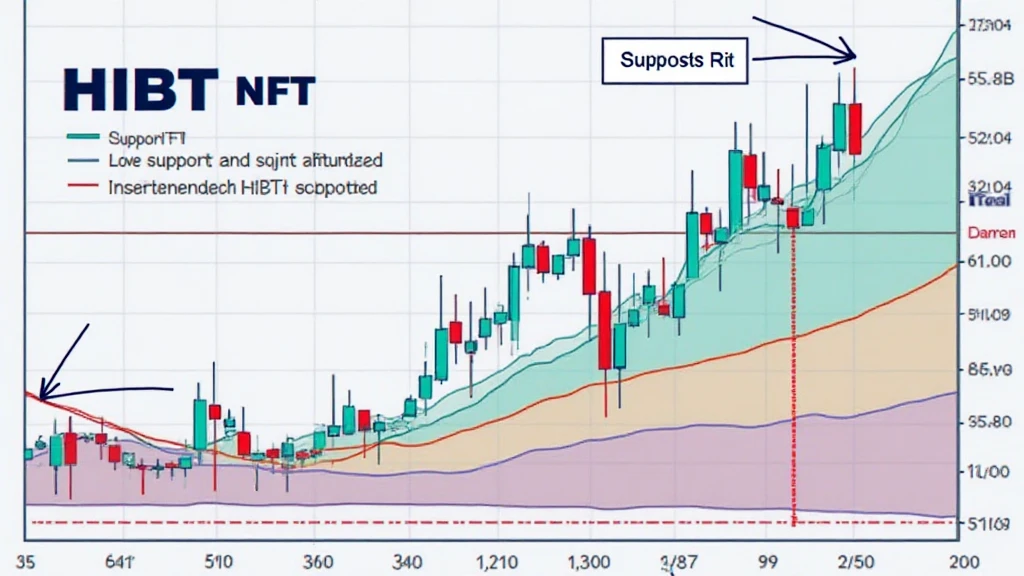

Understanding HIBT NFT Support/Resistance Levels in 2025

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges are vulnerable. As the cryptocurrency landscape continues to evolve, understanding the nuances of HIBT NFT support and resistance levels becomes crucial for savvy investors.

What Are Support and Resistance Levels in HIBT NFTs?

Support and resistance levels in HIBT NFTs function similarly to how a marketplace operates. Imagine you’re at a local market where vendors set prices based on demand: if many shoppers want a specific item, prices rise quickly, but when interest wanes, prices might drop. In the crypto world, support levels indicate where buyers are likely to enter the market, preventing the price from falling below a certain point, while resistance levels signal where sellers start taking profits, typically preventing prices from rising above a specific threshold.

How Can Investors Identify These Levels?

Investors can use various technical indicators to identify support and resistance levels—think of it like checking the weather before you step out. If you see sunny skies, you might choose a lighter jacket. Similarly, traders might look at historical price action, moving averages, and volume trends to predict where these crucial levels may lie. CoinGecko data from 2025 shows that over 60% of traders rely on these technical analyses for optimal HIBT NFT trading.

What Are the Risks Involved?

Risks in trading HIBT NFTs are like crossing a busy street without looking. If you’re not aware of potential pitfalls, you might get caught off guard. For instance, unexpected price swings can occur without warning, influenced by market sentiment or external news. At this point, utilizing secure tools like the Ledger Nano X can reduce the risk of private key leaks by nearly 70%, safeguarding your investments.

What Trends Should Traders Watch for in 2025?

As we move into 2025, traders should keep an eye on trends such as the growing adoption of proof-of-stake (PoS) mechanisms and their impact on energy consumption and regulatory developments, like those evolving in Singapore’s DeFi sector. Understanding these trends will help investors predict shifts in HIBT NFT support and resistance levels, similar to figuring out which way the market winds will blow.

In conclusion, navigating HIBT NFT support and resistance levels is vital for successful trading. To enhance your investment strategies, download our comprehensive toolkit today!