Introduction: The Rise of NFTs and Liquidity Pools

Have you ever wondered how liquidity pools can enhance your trading experience in the world of NFTs? As of 2023, the NFT market has surged, attracting over 300 million unique wallets. However, only a fraction of these wallets utilize liquidity pools effectively, leading to missed opportunities.

Understanding Liquidity Pools in the NFT Space

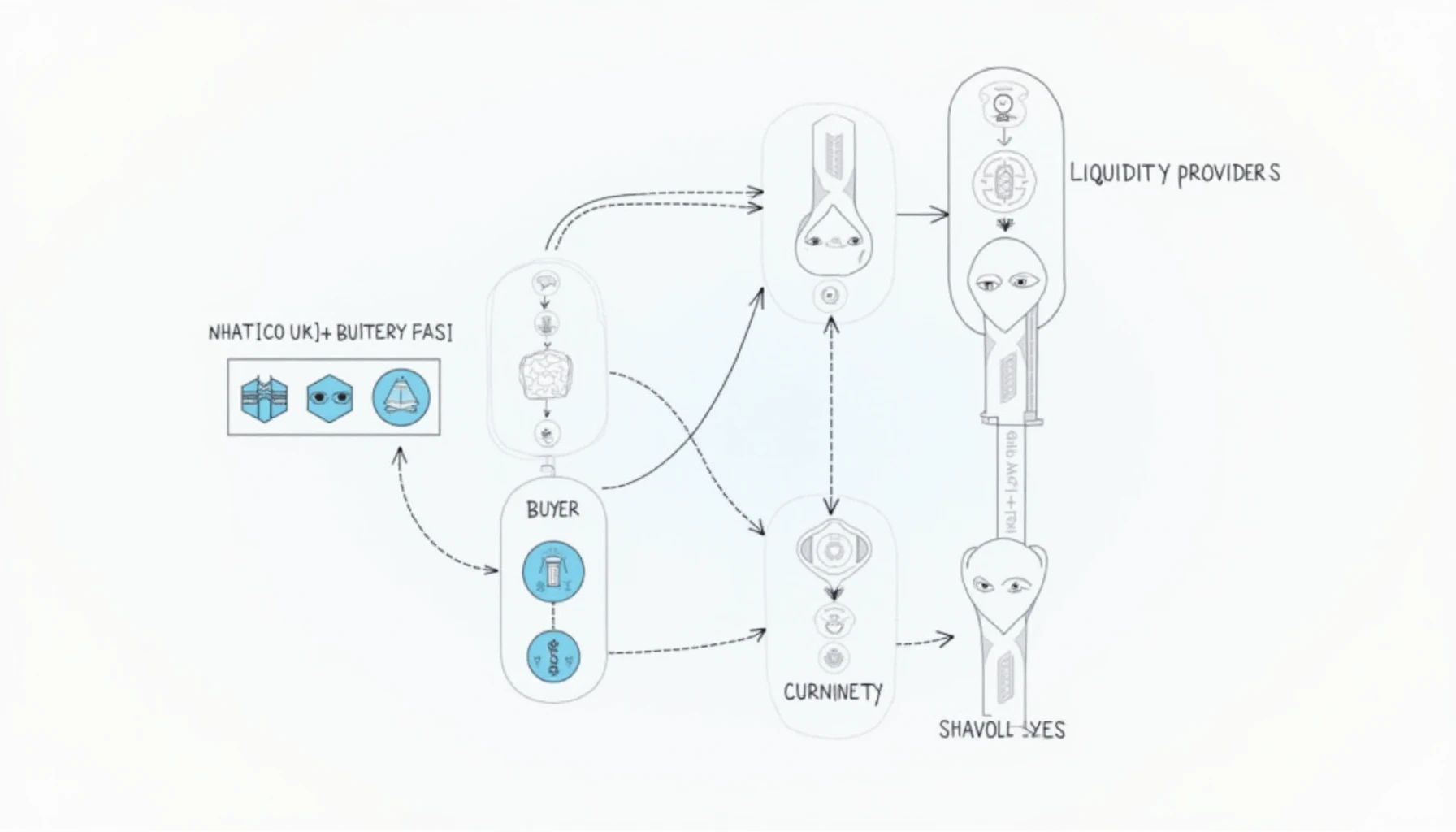

Liquidity pools are collections of funds locked in smart contracts that facilitate trading. But why are they essential? Simply put, they provide necessary liquidity for NFTs, ensuring that buyers and sellers can transact with ease, reducing slippage and volatility in NFT prices.

How Do Liquidity Pools Work?

Imagine a farmer’s market: sellers (liquidity providers) contribute goods (NFTs), while buyers pick from a variety of offerings. Here’s how you can leverage this:

- Yield Farming: Earn rewards for providing liquidity. This is akin to receiving bonuses for your contributions at the market.

- Arbitrage Opportunities: Take advantage of price discrepancies across different platforms, enhancing your profit margins.

Strategies for Maximizing HIBT NFT Liquidity Pools

1. Diversification

Just as a prudent investor diversifies their portfolio, consider creating a diverse liquidity pool. By pooling various NFT assets, you can minimize risk while capitalizing on market trends.

2. Incentivized Participation

Platforms often incentivize liquidity providers with rewards. For instance, some projects distribute governance tokens to pool participants, granting them voting power and additional earning potential.

3. Monitoring Market Trends

The NFT market is fast-paced. Setting up alerts for price movements and trading volumes allows you to react swiftly. Use analytical tools to track real-time data, ensuring informed decisions.

Best Practices for Entering Liquidity Pools

Entering liquidity pools isn’t just about adding funds. Consider these best practices:

- Understand Impermanent Loss: Be aware of potential losses from temporary price drops of the NFTs in your pool.

- Read the Fine Print: Different pools have varying rules and fee structures. Knowing these can prevent unexpected costs.

Conclusion: A Thriving Future for HIBT NFT Liquidity Pools

As the NFT landscape continues to evolve, adopting effective strategies for liquidity pools will be crucial for maximizing returns. Whether you are looking to provide liquidity or simply buy and sell, understanding these concepts is your gateway to success. Start exploring HIBT and benefit from the liquidity it offers today!

For more information on optimizing your digital currency transactions, be sure to check out our other articles at hibt.com. Always consult your local regulations before engaging in cryptocurrency activities.