Exploring HIBT Crypto Market Cap: 2025 Regulatory Trends

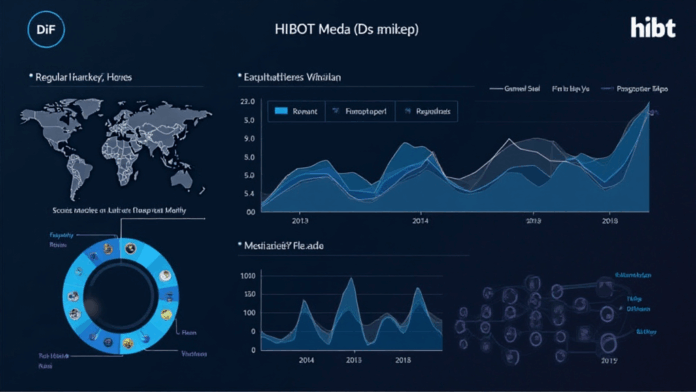

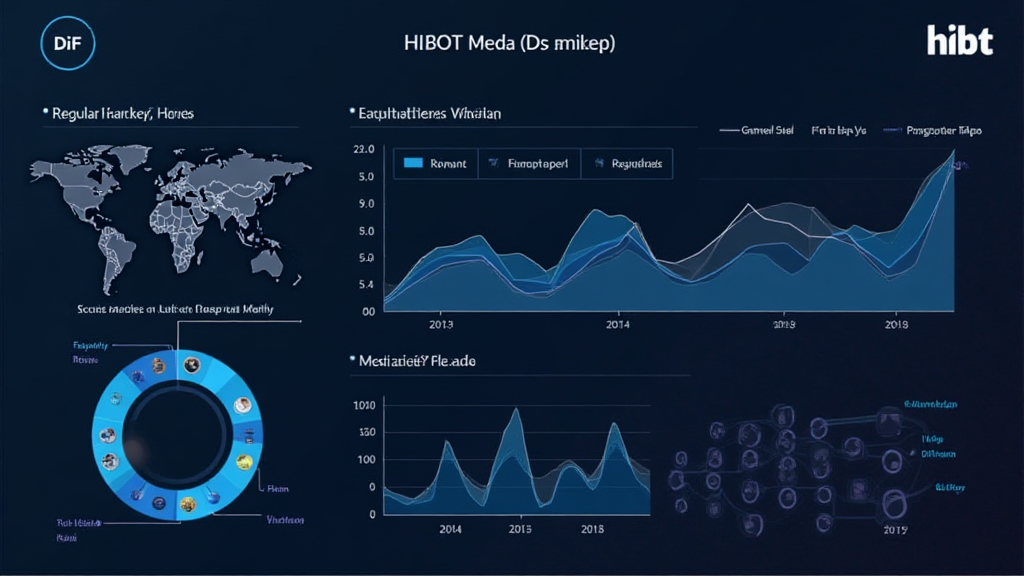

According to Chainalysis 2025 data, a staggering 73% of DeFi projects endure regulatory scrutiny across the globe, presenting risks for investors. This is particularly true concerning the HIBT crypto market cap, where understanding regulatory frameworks is pivotal for future growth.

Understanding DeFi Regulations in Singapore

So, what does this mean for investors? Imagine trying to buy a phone without knowing if it’s legal to sell in your country. That’s how traders feel with unclear regulations. In Singapore, authorities are working towards solidifying DeFi regulations, likely impacting the HIBT crypto market cap significantly.

Cross-Chain Interoperability and Its Importance

Cross-chain interoperability is essential in the crypto world, similar to how you need different currencies when traveling abroad. Currently, many projects struggle to communicate across blockchains, which can impede the expansion of HIBT in the crypto market. As developers focus on this, we can expect incredible growth in market cap.

Zero-Knowledge Proof Applications

Zero-knowledge proofs enhance privacy, much like wrapping your gift to keep the content a surprise. This technology is vital for the security of transactions, and as developers integrate it into HIBT and other tokens, we could see a spike in user confidence and a corresponding rise in HIBT crypto market cap.

Energy Consumption Comparison of PoS Mechanisms

When discussing proof-of-stake (PoS) mechanisms, think of it as comparing the energy efficiency of LED bulbs versus incandescent ones. PoS systems use significantly less energy, appealing to investors concerned about sustainability. With 2025 not far away, those who adapt efficiently can potentially increase their HIBT crypto market cap.

In conclusion, as we approach 2025, understanding these regulatory trends and technological advancements will be crucial for investors and traders alike. To enhance your strategy, download our toolkit for deeper insights.

Check out our security white paper now to stay ahead!

Disclaimer: This article does not constitute investment advice. Please consult your local regulatory body before taking action. For securing your assets, consider using Ledger Nano X to reduce private key exposure risks by up to 70%.

virtualcurrencybitcoin