Introduction

Did you know that less than 30% of cryptocurrency exchanges provide genuine liquidity metrics that traders need? Understanding crypto exchange liquidity metrics is essential for anyone looking to make informed trading decisions. By grasping these metrics, traders can evaluate the market’s stability and functionality.

What Are Liquidity Metrics?

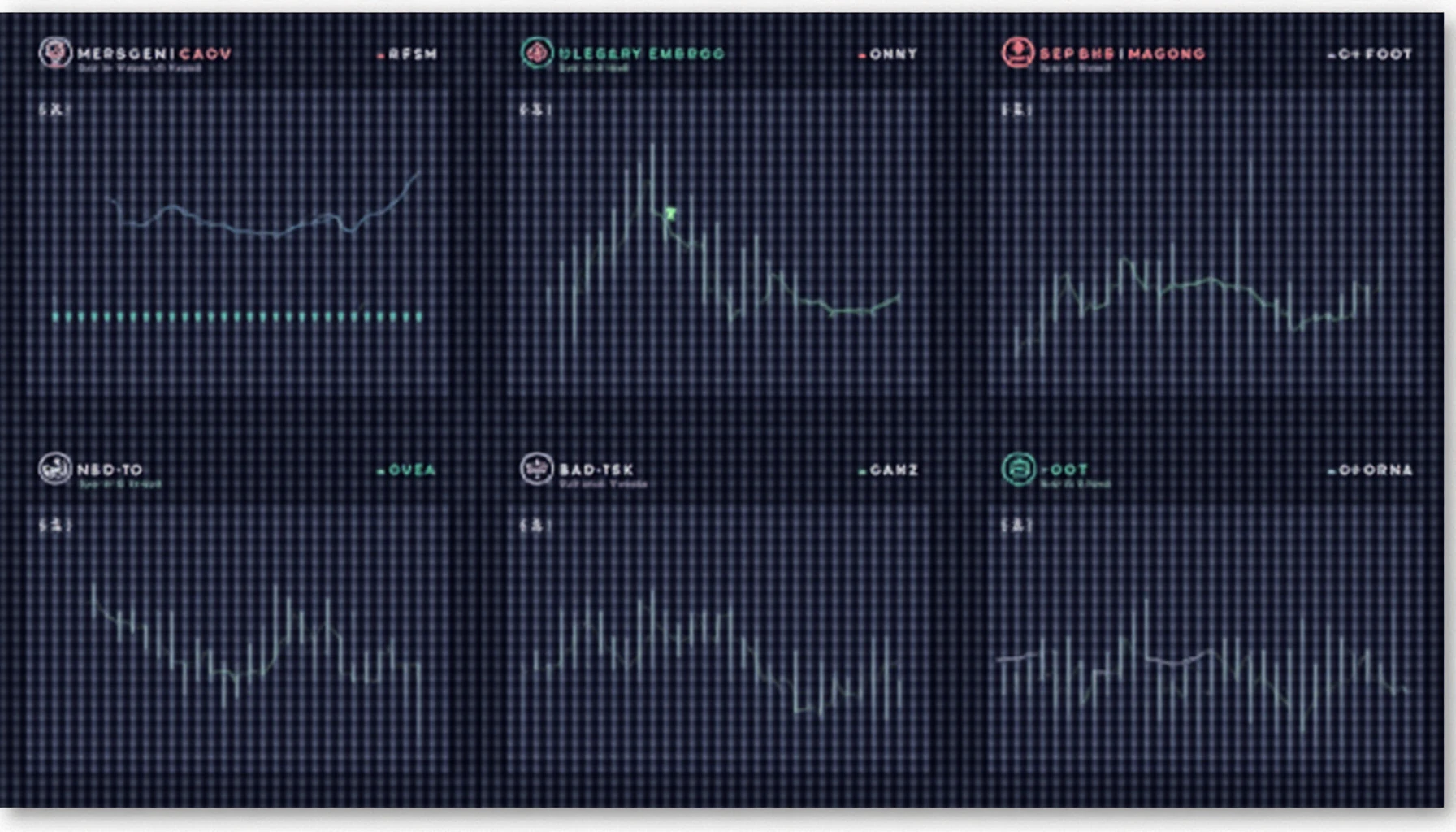

Liquidity metrics indicate how easily an asset can be bought or sold without affecting its price. In cryptocurrency trading, these metrics are crucial for assessing the health of an exchange. Here are some critical liquidity metrics:

- Order Book Depth: This refers to the number of buy and sell orders at various price levels.

- Trading Volume: A higher trading volume generally signifies better liquidity, ensuring that orders can be executed quickly.

- Bid-Ask Spread: The difference between the buy and sell price; a smaller spread typically indicates higher liquidity.

Why Are Liquidity Metrics Important?

Liquidity metrics serve several purposes in the crypto market:

- Reducing Slippage: High liquidity means low chances of slippage during trades, which can impact profits.

- Market Stability: Sufficient liquidity can prevent extreme price fluctuations, making trading less risky.

- Cost-Effective Trading: By understanding these metrics, traders can identify the best exchanges for low-cost transactions.

How to Analyze Liquidity Metrics?

Analyzing liquidity metrics can seem daunting, but it doesn’t have to be. Here are practical steps:

- Monitor Order Books: Regularly check order books to gauge the depth and number of active buy and sell orders.

- Use Analytical Tools: Utilize platforms that provide real-time liquidity data, like CoinMarketCap and CryptoCompare.

- Consider Historical Data: Look at past trading volumes and bid-ask spreads to predict future liquidity shifts.

Common Pitfalls to Avoid

When assessing liquidity metrics, traders should watch out for common pitfalls:

- Overlooking Market Manipulation: Some exchanges have low liquidity due to market manipulation strategies.

- Ignoring Local Regulations: Factors like Singapore’s cryptocurrency tax regulations can influence liquidity. Always stay updated.

Conclusion

By comprehending crypto exchange liquidity metrics, traders can make better decisions that enhance their profit margins and mitigate risks. Keep yourself educated about these metrics to navigate ever-changing market dynamics successfully. Don’t hesitate to explore reliable resources and tools to aid your trading journey.

For more insights into cryptocurrency trading metrics, visit hibt.com.