Introduction: The Need for Security in Cross-Chain Transactions

According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges contain vulnerabilities susceptible to attacks. With the growing reliance on cross-chain interoperability, the need for effective security measures is more crucial than ever.

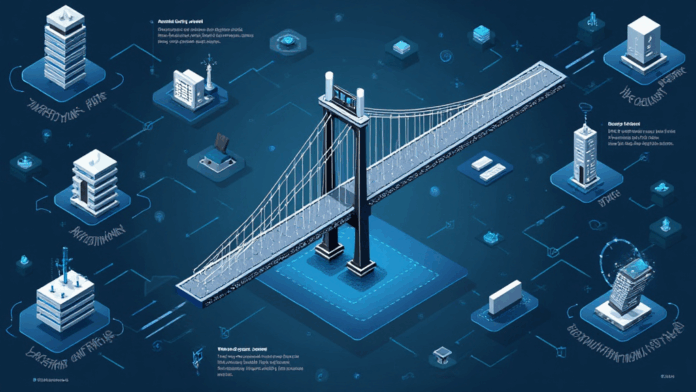

Understanding Cross-Chain Bridges: Currency Exchange Stands

Imagine you’re at a local market, and there’s a currency exchange stand. You want to trade your dollars for euros, but you need to trust that the exchange process is secure. Cross-chain bridges operate similarly, allowing users to swap assets across different blockchain networks. If there’s a flaw in the bridge’s security, much like a dishonest exchange clerk, your assets could be at risk.

Blockchain Forensic Analysis Tools: Your Security Watchdogs

Luckily, Blockchain forensic analysis tools act as watchdogs in this scenario. These tools help identify vulnerabilities and track illicit activities. Think of them as security cameras in our market analogy. They monitor transactions, ensuring everything is above board and giving you peace of mind when using cross-chain bridges.

Navigating Regulations: A Guide for Singapore and Beyond

As we move towards 2025, the regulatory landscape is also evolving. For instance, in Singapore, we anticipate new DeFi regulations that prioritize security and compliance. If you’re engaging in cross-chain transactions, being informed about these local guidelines is essential to avoid penalties and secure your investments.

Conclusion: Take Action with the Right Tools

Securing your assets across different blockchain networks is not just a necessity but a responsibility. With the emergence of Blockchain forensic analysis tools, you can significantly enhance your transaction security. Download our comprehensive toolkit today and take proactive steps to safeguard your investments.