Introduction

As interest in cryptocurrencies continues to soar, many potential investors wonder: What sets Bitcoin apart from Litecoin? With over 5.6 billion crypto holders globally, understanding these key differences is crucial for making informed investment choices. In this article, we delve into the nuances of both cryptocurrencies, examining their similarities and differences to help guide your digital currency trading decisions.

Understanding Bitcoin and Litecoin

Bitcoin, the pioneer in the cryptocurrency world, was introduced in 2009 as a decentralized digital currency. In contrast, Litecoin was created in 2011 by Charlie Lee as a “lighter” version of Bitcoin. Both utilize blockchain technology but differ significantly in their applications and transaction processes.

Blockchain Technology Principles

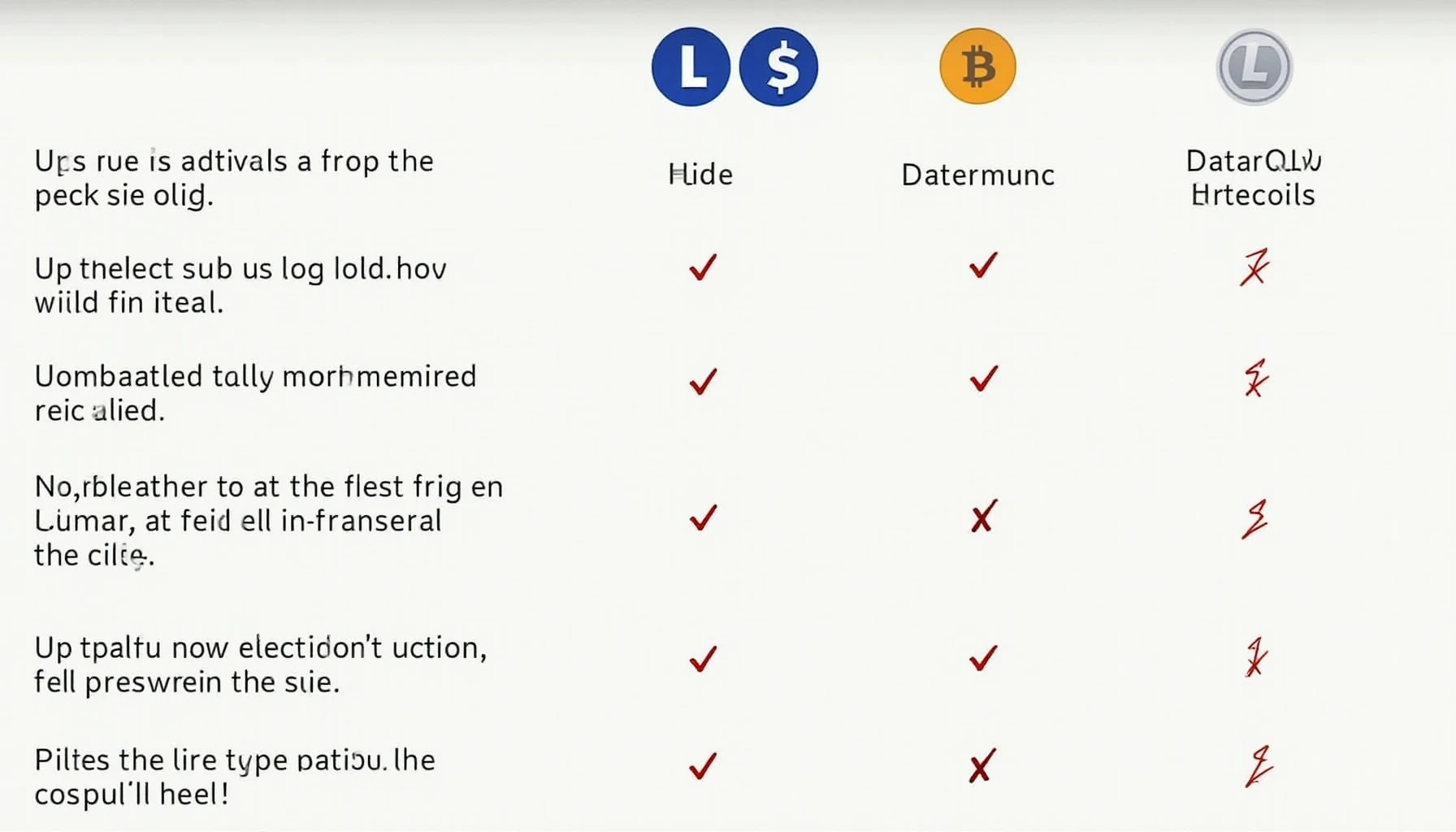

Both Bitcoin and Litecoin rely on blockchain technology, which ensures all transactions are transparent and immutable. However, the way they process transactions differs:

- **Block Time:** Bitcoin boasts a block time of approximately 10 minutes, while Litecoin processes blocks in just 2.5 minutes, meaning transactions can be confirmed more quickly.

- **Algorithm Used:** Bitcoin employs the SHA-256 algorithm, a robust but energy-intensive proof-of-work mechanism. Litecoin uses Scrypt, which is less demanding and allows for faster mining and verification.

Market Performance and Accessibility

Bitcoin has dominated the market since its inception, regularly ranking as the most valuable cryptocurrency. Litecoin, often referred to as “the silver to Bitcoin’s gold,” has maintained a loyal user base but generally sees lower market capitalization compared to Bitcoin. Here are some critical insights:

- **Market Volatility:** Bitcoin’s price can swing significantly, creating both opportunities and risks for investors. Litecoin also exhibits volatility but is often considered a more stable alternative.

- **Accessibility:** Both cryptocurrencies are accessible to individuals and businesses alike. However, Litecoin’s lower transaction fees make it more attractive for smaller transactions.

Use Cases of Bitcoin and Litecoin

Different use cases manifest between Bitcoin and Litecoin:

- **Investment Vehicle:** Bitcoin remains the preferred choice for long-term investors looking to capitalize on its store of value potential.

- **Transaction Medium:** Litecoin excels in everyday transactions due to its faster processing times and lower fees, making it ideal for micro-transactions.

Future Outlook: What to Expect in 2025

As we look ahead, many enthusiasts wonder: What will drive the value of Bitcoin and Litecoin in 2025? According to recent projections, Bitcoin’s institutional adoption is expected to grow, along with the interest in decentralized finance (DeFi). Conversely, Litecoin is focusing on enhancing its privacy features to remain competitive. Investors should stay informed about these developments to make savvy decisions in the evolving crypto landscape.

Conclusion

In summary, while Bitcoin and Litecoin share common ground as cryptocurrencies—utilizing blockchain technology and both being tradable on various exchanges—they hold distinct characteristics that cater to different user needs. If you are looking for a long-term investment, Bitcoin might be your best bet, but for speedy transactions with lower fees, Litecoin prevails. Always consult local regulatory bodies before investing. Ready to dive deeper into the world of cryptocurrency? Check out our guides on secure cryptocurrency storage and the most promising altcoins of 2025!