Understanding Bitcoin to SGD: 2025 DeFi Regulations in Singapore

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges have vulnerabilities, posing significant risks to digital currencies like Bitcoin. As Singapore prepares to regulate DeFi in 2025, understanding the implications for Bitcoin to SGD exchanges is crucial for investors.

The Growing Importance of DeFi Regulations

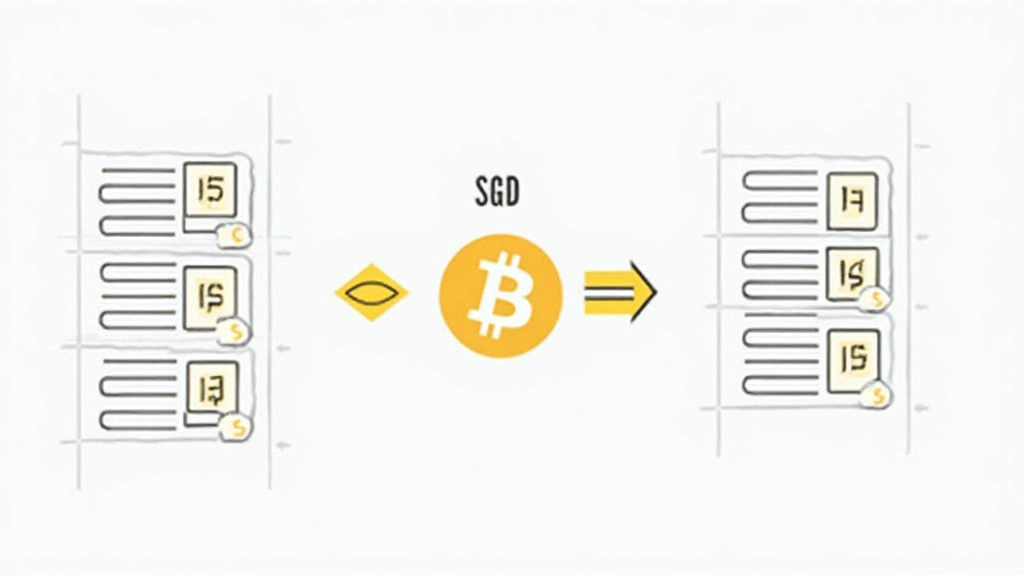

Just like how markets have rules to protect consumers, decentralized finance (DeFi) needs regulations. With the rise of platforms trading Bitcoin to SGD, the government aims to create a secure trading environment, akin to a local grocery store enforcing food safety standards.

Impact on Bitcoin Transactions in Singapore

New policies mean Bitcoin to SGD exchanges may need to adapt to strict guidelines. Think of it like how cafes must follow health codes—non-compliance can lead to shutdowns. This shift encourages traders and platforms to prioritize safety, which can help mitigate risks for investors.

Shifting Energy Dynamics: PoS vs. PoW

When discussing Bitcoin to SGD transactions, it’s essential to consider the energy consumption of different consensus mechanisms. For instance, Proof of Stake (PoS) is like using energy-efficient light bulbs compared to traditional ones. As regulations encourage eco-friendly practices, PoS’s lower energy usage could make it more appealing.

Future Predictions and Localized Insights

Looking towards the future, many anticipate that by 2025, policies will be clearer, fostering growth in the Singaporean crypto space. It’s similar to how traffic laws evolve as city populations grow—adaptation is key. As local regulations solidify, Bitcoin to SGD transactions could see increased stability and acceptance.

In conclusion, as Singapore gears up for DeFi regulations in 2025, Bitcoin to SGD exchanges will face new challenges and opportunities. For more insights, download our toolkit for navigating these changes.

This article does not constitute investment advice. Please consult local authorities like the MAS or SEC before making financial decisions. Tools such as Ledger Nano X can help reduce the risk of private key theft by up to 70%.

For more details on cross-chain security, check out our whitepaper. And, don’t forget to stay updated with our extensive resources at hibt.com. Explore the latest in cryptocurrency trends with us at virtualcurrencybitcoin.