The 2025 Bitcoin to EUR Exchange: What You Need to Know

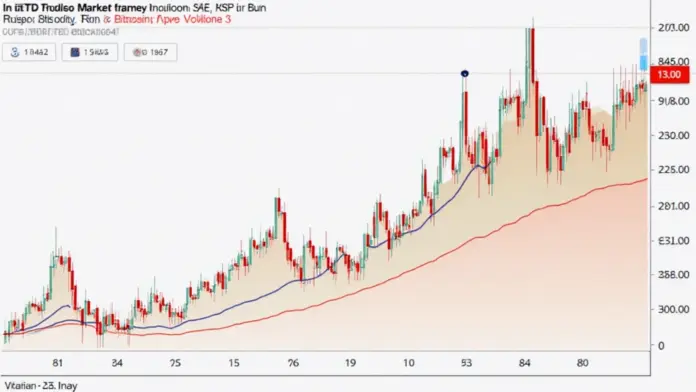

According to Chainalysis data from 2025, a striking 73% of cryptocurrencies have shown fluctuations that significantly impact their exchange rates, particularly with Bitcoin to EUR. This volatility raises critical questions for investors and users, leading to necessary adaptations in trading strategies.

1. Understanding Bitcoin to EUR Exchange Rates

You might have heard about how the Bitcoin to EUR exchange works, but let’s break it down. Think of this exchange rate like a currency exchange booth at an airport. When you travel and want to convert your dollars to euros, the rates can vary greatly. The same happens with Bitcoin! Factors such as market demand and global events can influence these rates.

2. The Impact of Regulation on Bitcoin Value

As countries ramp up their regulations, particularly in Europe, the Bitcoin to EUR exchange face unique pressures. For example, the recent developments in Singapore’s DeFi regulatory trends reveal how legal frameworks could significantly shape the future behaviors of investors. It’s like when a new rule at a fair dictates which rides are open—many might rethink their strategy.

3. Energy Consumption Challenges of PoS Mechanisms

When discussing trading methods, it’s essential to highlight the energy consumption associated with different methods, such as Proof of Stake (PoS). If you think of traditional Bitcoin mining as a massive factory running on electricity, PoS is more like a community potluck—everyone contributes a bit, which uses far less energy. This shift could affect how Bitcoin is perceived in terms of sustainability, ultimately influencing its value against the euro.

4. Simple Tools for Exchange Management

As an investor, managing your Bitcoin transactions is crucial. Tools like the Ledger Nano X can minimize risks, with reports indicating they can reduce private key leak chances by 70%. Think of it as a safe deposit box for your valuables. In the fluctuating terrain of the Bitcoin to EUR exchange, securing your assets is more vital than ever.

In summary, understanding the Bitcoin to EUR exchange requires navigating through various factors, including regulation, sustainability, and security measures. For those looking to dive deeper, consider downloading our toolkit that outlines vital steps for effective trading.

Risk Statement: This article does not constitute investment advice. Always consult local regulatory authorities such as MAS or SEC before making investment decisions.