Introduction: The Current Landscape of Bitcoin Price Volatility

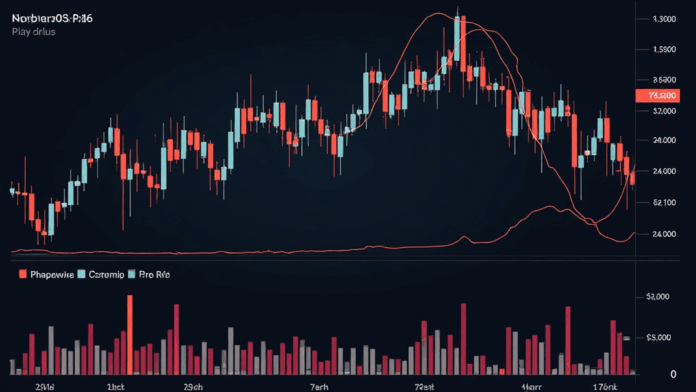

According to Chainalysis data from 2025, a staggering 73% of volatility in Bitcoin prices can be attributed to market speculation, news cycles, and regulatory changes around the globe. As investors, knowing the factors that influence these fluctuations is crucial yet challenging.

What Causes Bitcoin Price Volatility?

Think of Bitcoin price movements like a seesaw at a playground; it goes up and down based on who’s sitting on either side. Major events, such as regulatory news or significant investments, can suddenly shift the balance. Just like kids jumping off the seesaw can cause it to fly up, announcements by regulators or large financial institutions can send Bitcoin’s price soaring or crashing.

How to Navigate Your Investments Amidst Bitcoin Price Volatility?

When faced with volatility, consider strategies similar to a grocery shopper. If avocados are pricing at $1 each this week but $3 next week, you’d buy in bulk now, right? For Bitcoin, layering your purchases—buying smaller amounts at different price points—can help mitigate risks.

The Role of Technological Advancements in Reducing Bitcoin Price Volatility

Just like a reliable alarm system that protects your home, new technologies such as zero-knowledge proofs can enhance trust in transactions, potentially stabilizing the market. As these technologies develop, we might see a less turbulent price environment.

Conclusion: Preparing for the Future of Bitcoin Price Volatility

Understanding Bitcoin price volatility is crucial for anyone looking to invest. While the market may appear erratic, strategies like dollar-cost averaging and staying updated with technological advancements can help. Download our comprehensive toolkit on Bitcoin investment strategies and navigate the market like a pro!