Understanding Bitcoin Mining Rig: 2025’s Trends and Challenges

According to Chainalysis’s 2025 data, a staggering 73% of Bitcoin mining rigs are not optimized for energy efficiency, leading to increased operational costs and carbon emissions. As the world pivots toward greener alternatives, understanding the nuances of Bitcoin mining rigs is pivotal for miners and investors alike.

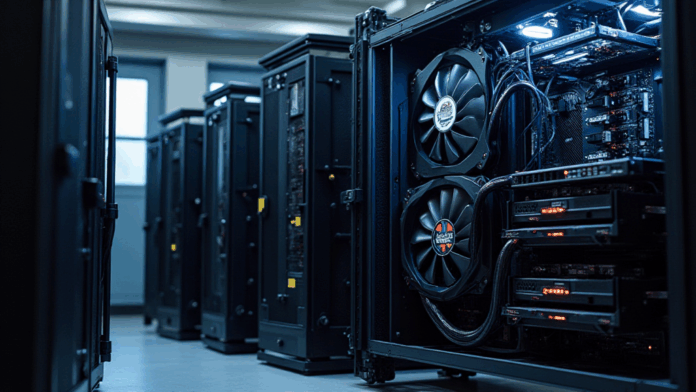

What Are Bitcoin Mining Rigs?

Imagine you’re at a market, and you see a stall specifically for bitcoin – that’s a Bitcoin mining rig. It’s a system that allows you to ‘mine’ or extract bitcoins by solving complex mathematical problems. Just like the friendly vendor who helps you pick the best fruits, a mining rig helps you acquire cryptocurrencies through computational power.

2025 Trends: The Rise of Energy-Efficient Mining

As we look ahead, the drive for sustainability is pushing miners to innovate. You may have noticed how some energy providers are now offering green options; similarly, Bitcoin mining rigs are evolving to utilize renewable energy sources. In 2025, you’ll likely find a significant shift in mining operations, particularly in regions like Dubai, where incentives for eco-friendly practices are being implemented.

Regulatory Landscape: The Singapore DeFi Regulation

With the rapid growth of DeFi, it becomes essential to stay updated on how regulations can impact Bitcoin mining operations. Just as a market can be affected by the latest health guidelines, the DeFi sector is bracing for 2025 regulatory frameworks from MAS that will undoubtedly influence Bitcoin mining activities in Singapore.

Comparing Proof of Work and Proof of Stake Energy Consumption

You might have heard of Proof of Work (PoW) and Proof of Stake (PoS) when it comes to cryptocurrencies like Bitcoin and Ethereum. Think of PoW like a bakery that’s working hard to create delicious pastries, whereas PoS is more like letting people queue for a treat. As we analyze the energy consumption gap, Bitcoin mining rigs operating under PoW are often more resource-intensive, leaving room for innovation.

Conclusion and Call to Action

As we navigate through changing trends in Bitcoin mining rigs, understanding costs, regulatory shifts, and energy consumption is key for investors. Stay ahead by accessing our Bitcoin mining toolkit and top strategies for 2025!

Note: This article does not constitute investment advice. Please consult local regulatory authorities like MAS or SEC before making any investment decisions.

Protect your assets with tools like Ledger Nano X, reducing private key exposure risk by up to 70%.