Exploring Bitcoin Microstructure: Navigating the Future of Cross-Chain Operations

According to Chainalysis 2025 data, global vulnerabilities in cross-chain bridges affect 73% of existing platforms. As the crypto ecosystem grows, understanding the Bitcoin microstructure becomes crucial for secure and efficient transactions.

What is Bitcoin Microstructure?

To put it simply, the microstructure of Bitcoin is like the way a local market operates. Imagine a bustling market with vendors exchanging goods – each stall has its own way of managing transactions. Some prefer cash, while others accept cards or even barter. Bitcoin microstructure tackles how different players engage in buying, selling, and trading this digital asset. Just like vendors need efficient processes to keep the market flowing, Bitcoin’s network needs robust systems to ensure seamless transactions.

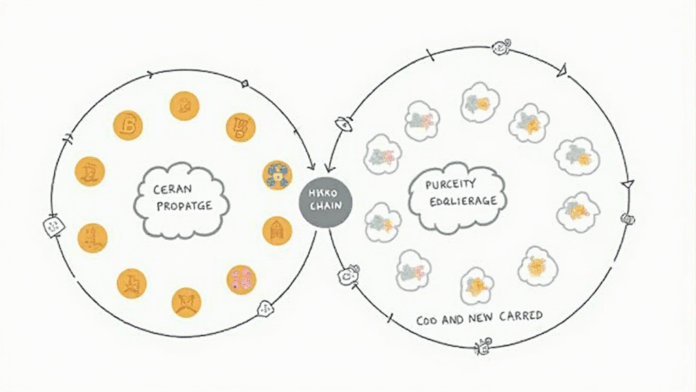

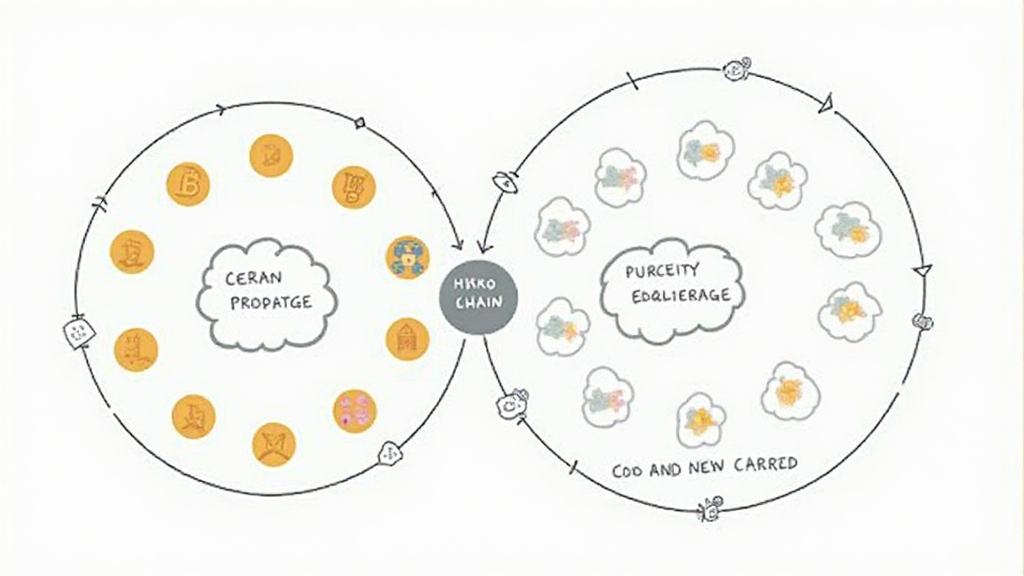

Cross-Chain Interoperability Explained

You’re probably wondering, how do different blockchains talk to each other? Think of cross-chain interoperability like a currency exchange booth at a busy airport. You wouldn’t want to wait in a long line just to swap your dollars for euros, right? This technology allows various blockchains to communicate effectively, meaning transactions can flow freely across platforms. It’s not just about quicker trades; it fosters a collaborative ecosystem for DeFi projects, a critical point as we look toward trends like the 2025 Singapore DeFi regulatory landscape.

Understanding the Impact of Zero-Knowledge Proofs

Zero-knowledge proofs might sound complex, but let’s break it down. Think of it like when you try to convince your friend you’ve read a book without revealing the details. You provide proof of knowledge without sharing private information. In the Bitcoin microstructure, these proofs offer a layer of privacy while validating transactions. This is having significant implications for transaction security, especially where user data protection is concerned.

Comparative Analysis: PoS Mechanism Energy Consumption

Let’s compare the energy use of Proof of Stake (PoS) mechanisms versus traditional mining. It’s like comparing the power consumption of an electric car to a gas guzzler. While Bitcoin’s PoW can be energy-intensive (think of running a big factory), PoS consumes significantly less, enhancing sustainability in the Bitcoin ecosystem. This is vital as the crypto world moves toward greener solutions, questioning how these mechanisms could adjust as regulations evolve.

In conclusion, understanding Bitcoin microstructure is essential for anyone navigating the cryptocurrency waters. Equipped with the right tools, such as the Ledger Nano X, you can reduce the risk of private key exposure by up to 70%. For further insights and a comprehensive toolkit, don’t forget to download our resource package!