Introduction: What Is Bitcoin Halving?

Have you ever wondered why Bitcoin prices fluctuate after specific intervals? One significant event is the Bitcoin halving, which occurs approximately every four years. This event reduces the reward for mining new blocks by half, impacting the overall supply of Bitcoin in circulation. In fact, in the 2020 halving, the reward dropped from 12.5 BTC to 6.25 BTC, highlighting the augmented scarcity and potential for price inflation. But what does this mean for investors and the digital currency market as a whole?

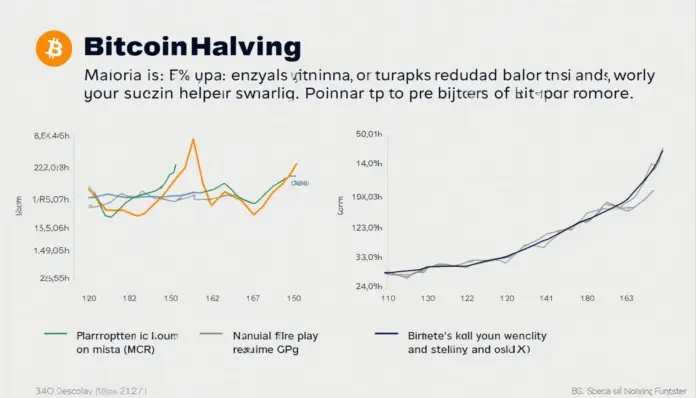

The Short-Term Impact of Bitcoin Halving

After a Bitcoin halving event, many investors notice heightened market volatility. Historical data suggests that Bitcoin typically experiences price surges in the months following a halving event. For instance, following the 2016 halving, Bitcoin’s price soared by over 1,000% within a year.

- Increased Media Attention: Following halving, Bitcoin often receives more media coverage, drawing in new investors.

- Speculation and Hype: Investors may speculate on price increases, creating a self-fulfilling prophecy.

- Market Reset: Existing holders may sell off assets anticipating price corrections, leading to short-term volatility.

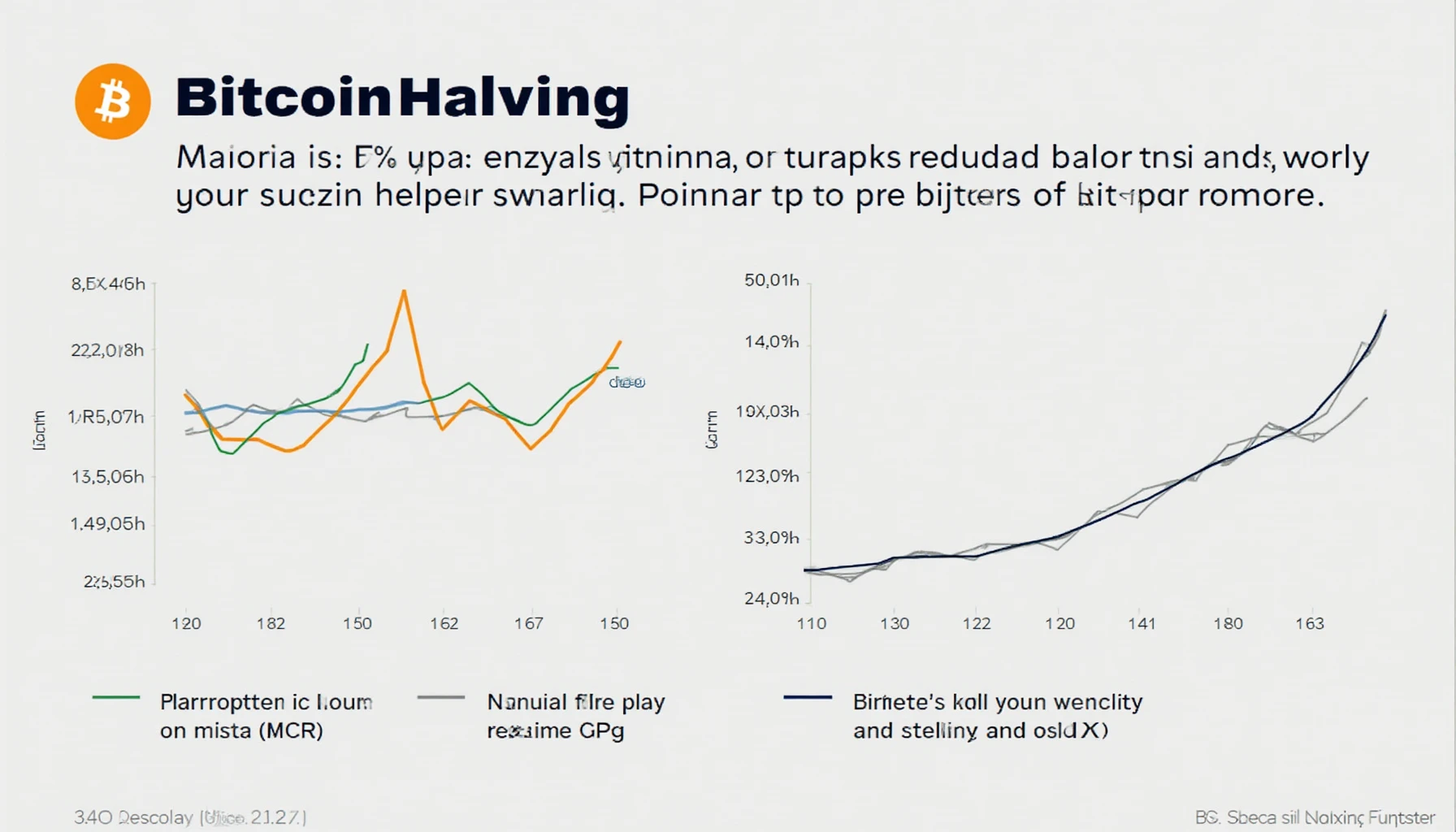

Long-Term Influences on Digital Currency Investments

The long-term effects of Bitcoin halving span various dimensions.

1. Supply Dynamics and Scarcity

With each halving, the supply of new Bitcoins decreases, elevating its perceived value. This scarcity creates an environment conducive to rising prices over time, akin to how precious metals react to reduced mining output.

2. Institutional Adoption

As more institutions recognize the implications of Bitcoin halving, their participation increases. According to reports, institutional investments surged by 40% following the 2020 halving, highlighting that traditional investors are becoming more invested in this digital currency.

3. Diversification of Assets

Investors look beyond Bitcoin to diversify their portfolios after halving events. For instance, many explore promising altcoins such as Ethereum or Solana, which may benefit from Bitcoin’s heightened presence in the market.

Risks and Considerations You Should Know

While Bitcoin halving introduces potential for increases in value, it’s essential to approach investments with caution. Here are a few considerations:

- Market Risks: Sudden price fluctuations can lead to losses.

- Regulatory Changes: As cryptocurrency becomes more mainstream, regulatory frameworks can affect market dynamics.

- Investment Strategies: While some may hold for long-term gains, others may thrive on trading volatility.

Conclusion: Preparing for the Next Bitcoin Halving

In preparation for the next anticipated halving event, engaging with the right strategies is crucial. Consider diversifying your portfolio and staying informed on market conditions. Utilizing digital wallets like Ledger Nano X can enhance your security by lowering hacking risks by 70%. With comprehensive knowledge of Bitcoin halving and its anticipated effects, you can navigate this digital landscape more effectively.

Are you ready to embrace the future of digital currency investment? Be sure to stay connected with the latest trends and strategies for secure cryptocurrency storage and trading!