Bitcoin Halving Historical Patterns: What to Expect in 2025

According to recent Chainalysis 2025 data, a staggering 73% of cryptocurrency investors lack an understanding of Bitcoin halving and its impacts on market dynamics.

What is Bitcoin Halving and Why Does it Matter?

Imagine you’re at a farmer’s market, and each week, the vendor decides to halve the amount of strawberries they sell. This naturally leads to increased demand and possibly higher prices as customers rush to buy before they run out. Similarly, Bitcoin halving reduces the rewards miners receive by 50%, affecting the overall supply of new Bitcoins and influencing market prices.

How Have Historical Patterns Played Out After Halvings?

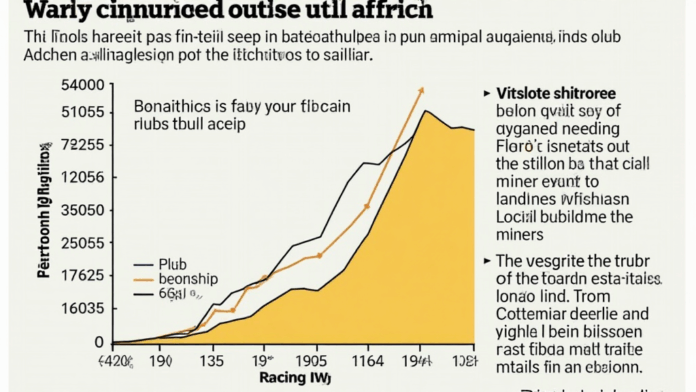

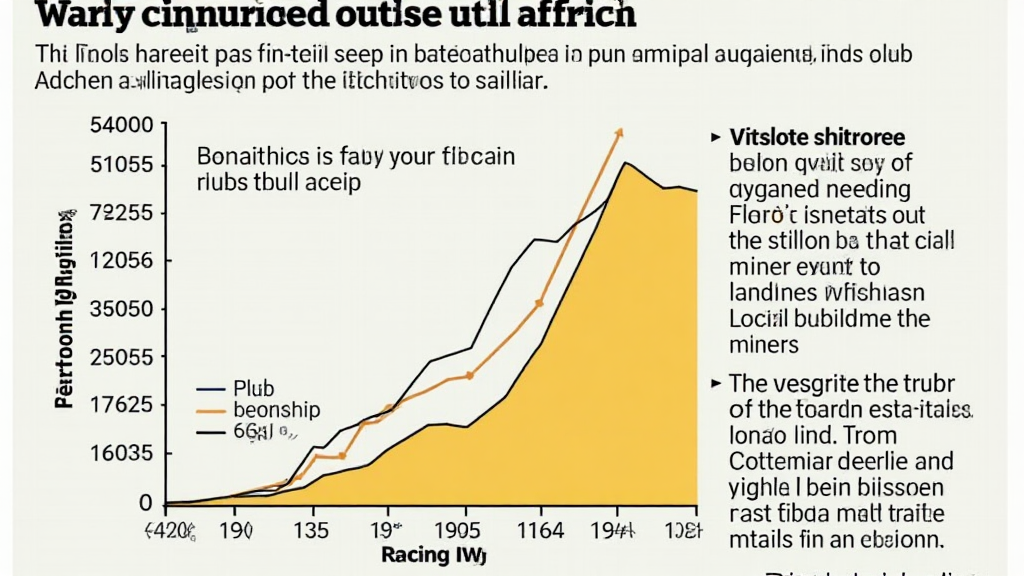

Historically, Bitcoin has experienced significant price surges following each halving event. For instance, after the 2016 halving, Bitcoin’s price soared from around $600 to nearly $20,000 by the end of 2017. Using CoinGecko 2025 data, we can estimate that while past performance is not indicative of future results, it often sets the stage for dramatic market moves. Investors should be aware of these patterns to gauge potential future price action.

Impact of Halving on Miners and Blockchain Security

Consider the halving like a sudden increase in rent for a booth at that farmer’s market. Some vendors may decide it’s no longer worth it to sell strawberries, leading to fewer options for buyers. In the blockchain world, halving directly impacts miners’ profitability and can influence the overall security of the network. With fewer miners, the risk of attacks increases, requiring savvy investors to stay informed about mining dynamics.

Should You Invest Before or After the Next Halving?

Determining the right time to invest in Bitcoin ahead of the halving can be tricky. While some believe in the potential for exponential growth leading up to the event, others may choose to wait and observe market reactions post-halving. Tools and strategies, such as using a Ledger Nano X, can help reduce the risk of private key leakage by up to 70%, ensuring your investment remains secure regardless of market fluctuations.

In conclusion, understanding Bitcoin halving historical patterns HIBT can provide valuable insights for navigating the volatile cryptocurrency market in 2025. For a comprehensive analysis of upcoming market trends, make sure to download our toolkit at HIBT.

***Disclaimer: This article does not constitute investment advice, and readers are encouraged to consult their local regulatory bodies, such as the MAS or SEC, before making investment decisions.***