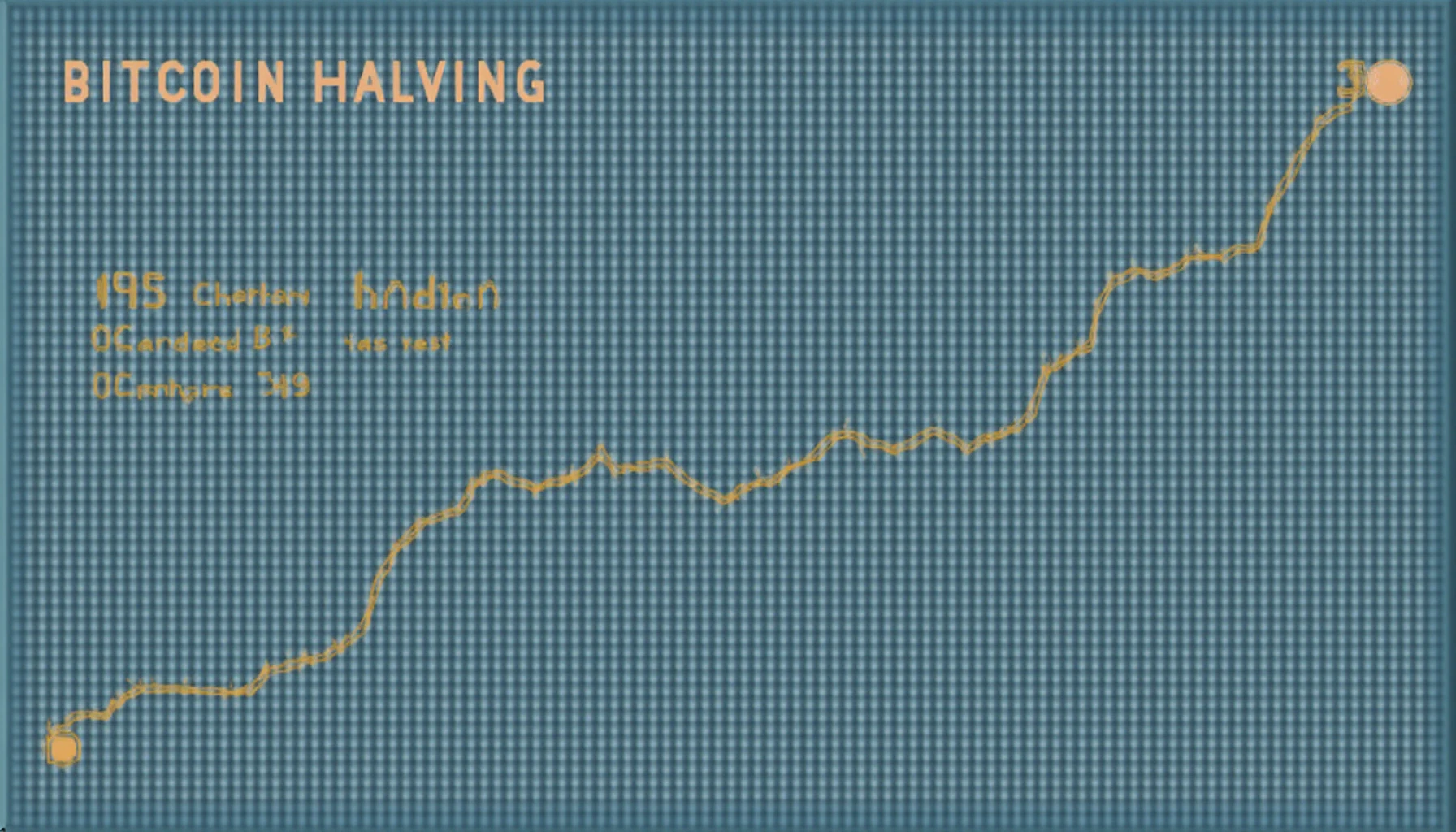

Understanding Bitcoin Halving Historical Data: A Dive into Its Impacts and Patterns

Did you know that Bitcoin’s price often reacts dramatically around the halving events? According to historical data, each halving has led to significant price surges. But what does this mean for investors and traders?

What is Bitcoin Halving?

Bitcoin halving is a pre-programmed event that occurs approximately every four years, specifically every 210,000 blocks mined. During this event, the reward for mining new Bitcoin blocks is cut in half, reducing the rate at which new bitcoins are generated. This mechanism is crucial to Bitcoin’s supply and economic model.

Historical Context and Patterns

- 2012 Halving: The first halving occurred in November 2012, decreasing the reward from 50 BTC to 25 BTC. Following this event, Bitcoin’s price saw a meteoric rise, peaking at around $1,000 by late 2013.

- 2016 Halving: The second halving, occurring in July 2016, saw the reward further reduced to 12.5 BTC. Bitcoin’s price rallied to nearly $20,000 by December 2017, demonstrating the potential impacts of supply reduction.

- 2020 Halving: In May 2020, the reward was cut to 6.25 BTC. By the end of 2021, Bitcoin had reached an all-time high of over $60,000, reinforcing the correlation between halving events and price increases.

Why Does Halving Affect Prices?

The direct relationship between Bitcoin halving and price fluctuations can be attributed to several factors:

- Reduced Supply: Halving lowers the number of new bitcoins produced, creating scarcity.

- Increased Demand: As awareness grows and adoption expands, demand often surpasses supply, leading to price increases.

- Market Speculation: Traders and investors often anticipate price increases, contributing to a self-fulfilling prophecy.

Future Prospects: What to Expect in 2024

The next Bitcoin halving is expected to occur in April 2024, reducing the reward to 3.125 BTC. If historical trends hold, this event might trigger significant market activities. However, it’s essential to be cautious and understand the broader market influences.

With emerging technologies and market dynamics, such as Institutional Investment and increased regulation in regions like the Singapore cryptocurrency market, prices may behave differently post-halving.

Final Thoughts

Staying informed about Bitcoin halving historical data is vital for anyone involved in digital currency trading. Understanding past patterns can guide smarter investment decisions and better prepare for future events. Remember, though: investments in cryptocurrencies carry risks. Consult local regulatory bodies and do your homework before jumping in.

Download our comprehensive guide on how to safely store cryptocurrencies! Don’t miss out on optimizing your investments.

For more information on cryptocurrency trends and trading strategies, check out our other articles on hibt.com.