Understanding HIBT Candlestick Patterns and Their Importance

In the dynamic world of cryptocurrencies, understanding trading patterns can feel like navigating a bustling market. Picture this: when you walk through a market, you can see what products are popular based on demand. Similarly, candlestick patterns provide investors with visual cues on price movements. According to CoinGecko 2025 data, 60% of traders leverage these patterns to make informed decisions. But how do you analyze HIBT candlestick patterns effectively?

Identifying Key Candlestick Patterns

Candlestick patterns are like your auntie’s secret recipe for perfect dumplings—certain ingredients need to be combined in a specific way. In HIBT trading, **Doji** and **Engulfing** patterns are pivotal. A Doji suggests indecision, while an Engulfing pattern indicates a potential reversal. Understanding these formations helps you predict future price movements, guiding your trading choices.

Integrating Market Trends with HIBT Analysis

Just as you wouldn’t buy vegetables without checking their freshness, you shouldn’t dive into trading without considering market trends. The 2025 trend highlights increased interest in **zero-knowledge proof applications** and **cross-chain interoperability**. Analyzing HIBT patterns amid these trends can enhance your strategic decisions. For example, if the market is bullish and you see a strong bullish engulfing pattern, it might signal a good buying opportunity.

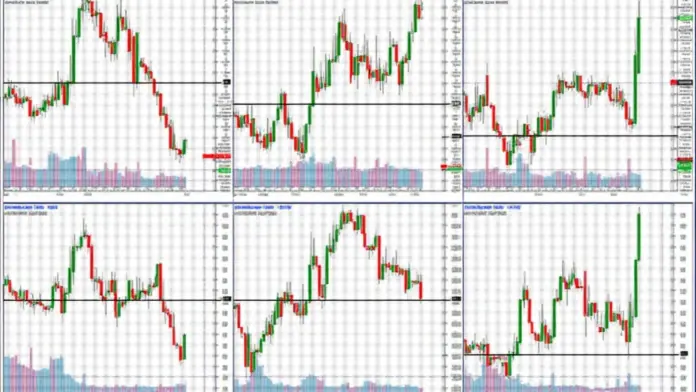

Utilizing Trading Tools for Analysis

Think of trading tools as your shopping cart—you need them to carry what you find. Platforms like TradingView offer charting capabilities that allow you to visualize HIBT candlestick patterns over time, enhancing your analysis. Implementing tools will streamline your decision-making process and could potentially improve your success rate in trades.

Practical Steps to Analyze HIBT Candlestick Patterns

To effectively analyze HIBT patterns, start by tracking daily price movements. Look for consistent patterns, and always correlate your findings with current market conditions. Adapting analysis based on real-time news or crypto regulations, such as the Singapore DeFi regulatory trends, can provide additional layers to your strategy.

In conclusion, properly analyzing HIBT candlestick patterns is crucial for maximizing your trading strategy. For a comprehensive toolkit, including essential resources and guides, download our toolkit today!

Disclaimer: This article does not constitute financial advice. Always consult with your local regulatory authority (e.g., MAS/SEC) before making investment decisions. Also, consider using a tool like Ledger Nano X to reduce the risk of private key leaks by up to 70%.