Introduction

According to Chainalysis’s 2025 data, a staggering 73% of cryptocurrency exchanges show vulnerability. This alarming statistic underlines the need for investors to gain a solid understanding of trading volume trends, particularly for HIBT, as it plays a crucial role in making informed trading decisions.

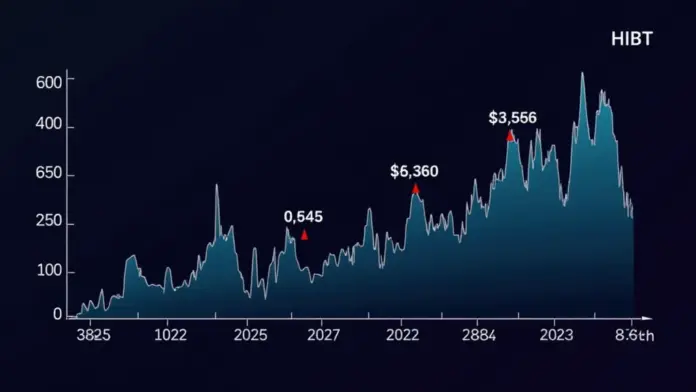

Understanding HIBT Trading Volume

Before diving into the trends, let’s break down what trading volume means. Think of it as the amount of HIBT that changes hands during a specific period, much like how oranges are sold by weight in a market. The higher the volume, the more active the market is, indicating strong interest from investors.

Analyzing Volume Trends: The Basics

When analyzing volume trends, it’s essential to look for patterns over time. Imagine walking through a bustling marketplace: some days are busy, while others are slow. A sudden increase in HIBT trading volume can signify upcoming news or events, just like a sudden influx of shoppers might hint at a sale day. Additionally, tracking these fluctuations can help you predict potential price movements.

Using Data Analysis Tools

Tools like CoinGecko can provide invaluable insights into HIBT’s historical trading volumes. By using these tools, you can create a clearer picture of where HIBT stands in the marketplace. Just think of it as using a shopping cart to keep track of all the oranges you want as you navigate through the market—you’ll always know what you have and what you need to purchase.

Localizing the Analysis: Trends in Singapore

In regions like Singapore, understanding the 2025 DeFi regulatory trends becomes crucial. Local regulations can impact trading volumes significantly. For instance, if new regulations are introduced, many traders might pull back, similar to how customers would leave a market if the prices suddenly increased. Keeping an eye on local news can help you prepare for such shifts.

Conclusion

In summary, mastering how to analyze HIBT trading volume trends will empower you to make better trading decisions. Take time to explore data analysis tools, stay informed about local trends, and monitor changes in volume closely. For a deeper analysis, download our comprehensive toolkit for resources that can enhance your trading strategies today!