Introduction: The Critical Need for Better Insights

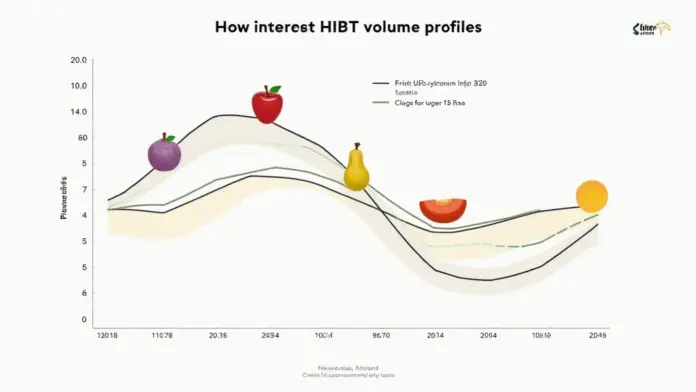

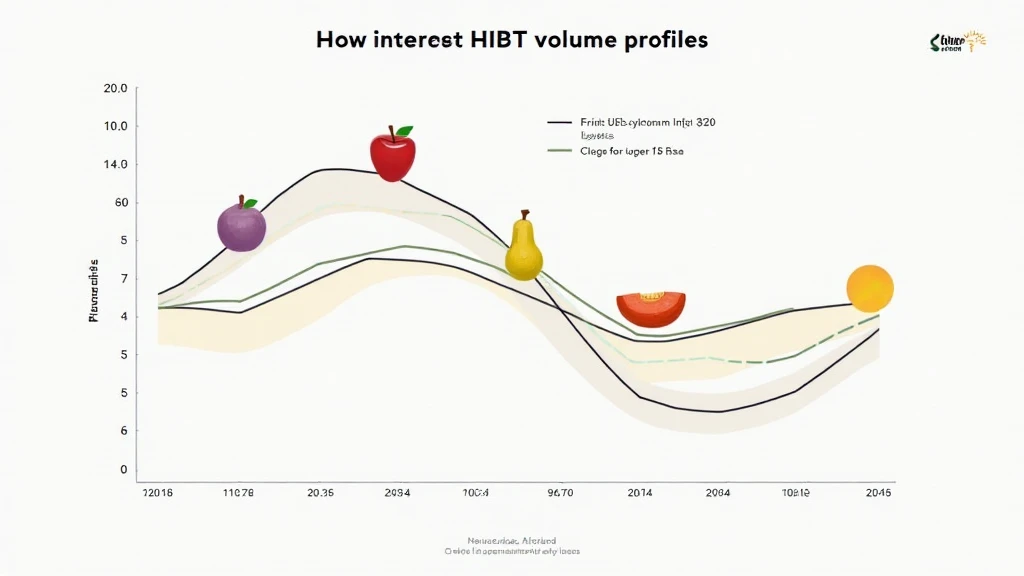

According to Chainalysis’ 2025 data, a staggering 73% of volume profiles in the HIBT space reveal critical inefficiencies. Understanding How to interpret HIBT volume profiles can be the difference between success and failure in trading.

What Are HIBT Volume Profiles?

Think of a HIBT volume profile like a market stall filled with varying amounts of produce. Each type of fruit represents a different trading price level, while the amount of fruit corresponds to the trading volume at that level. The wider the stall, the more trading activity exists, thus giving us vital insights into price movements.

Why Is Volume Important in HIBT Trading?

You may have noticed that certain fruits fly off the shelves while others sit untouched. In trading, this is analogous to supply and demand. By interpreting HIBT volume profiles, traders gauge how much of an asset is being purchased at different prices, which is crucial for making informed decisions.

How To Analyze HIBT Volume Profiles Effectively

When diving into the sea of data, imagine you’re a fisherman looking for the best spot to cast your net. By analyzing the volume at different price levels, you can identify where the most trading activity is concentrated, like the best fishing holes. This information helps to forecast potential price movements with a degree of confidence.

Common Mistakes in Volume Profile Interpretation

Just like confusing ripe fruits for unripe ones can lead to poor choices at the market, misinterpreting volume profiles can lead to faulty trading decisions. Common pitfalls include ignoring significant spikes or drops, or failing to recognize the impact of news on trading behavior, which can throw your analysis off course.

Conclusion: Take Action Now!

To improve your trading strategy, understanding How to interpret HIBT volume profiles is essential. Download our exclusive toolkit designed to help you leverage these insights and avoid the common mistakes that can lead to poor performance.

Risk Disclosure: This article does not constitute investment advice. Please consult your local regulatory authority before making investment decisions.

To lower the risk of private key exposure by 70%, consider using Ledger Nano X.

For more insights, visit 查看跨链安全白皮书 and stay informed!