2025 HIBT Crypto Lending Platform Review

According to Chainalysis data for 2025, a staggering 73% of crypto lending platforms encounter significant security vulnerabilities. Let’s dive into the HIBT crypto lending platform, a promising new player in the market, and see how it stands up against these challenges.

What is HIBT and How Does it Work?

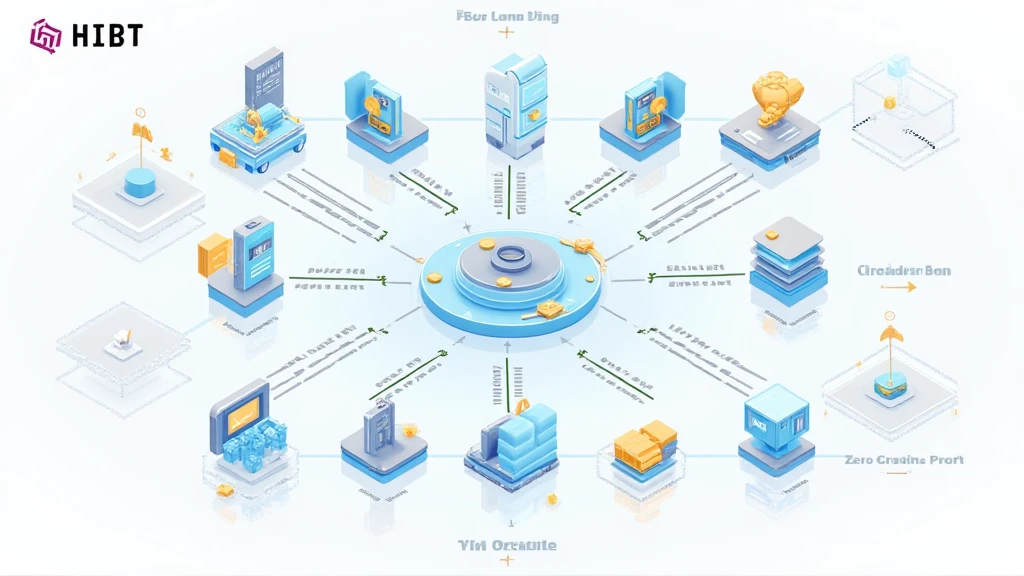

Think of HIBT as a savings account for your cryptocurrencies. Just like you deposit money in a bank to earn interest, you deposit digital assets into HIBT. In return, you earn interest over time. This is made possible thanks to the ever-growing decentralized finance (DeFi) space, which uses innovative technologies like smart contracts.

Cross-Chain Interoperability: The Bridge Between Blockchains

You might wonder how HIBT connects with various blockchains. Imagine it as a currency exchange booth in a busy market. Just like you can exchange dollars for euros, HIBT enables the exchange of assets across different blockchains seamlessly. This feature allows users to maximize their earnings while minimizing risks.

Zero-Knowledge Proofs: Keeping Your Data Private

You probably know that sharing personal information can lead to privacy concerns. HIBT employs zero-knowledge proof technology, akin to giving a trusted friend access to your house without revealing the key. This means you can prove you have an asset without exposing your identity or the asset itself, enhancing your data privacy while using the platform.

The Future: What’s Next for HIBT in Singapore?

The landscape in Singapore is rapidly changing, especially regarding DeFi regulations. As of 2025, navigating these laws will be crucial for platforms like HIBT. They aim to ensure compliance while providing users with the best lending experience. Think of them as a tour guide, helping you stick to the right path while exploring a new city.

In conclusion, HIBT crypto lending platform offers innovative features and security measures that tackle significant concerns in the DeFi sector. As you explore the world of digital finance, consider downloading our comprehensive toolkit for more insights into managing your cryptocurrency.

View the cross-chain security white paper.

Risk Disclosure: This article does not constitute financial advice. Please consult your local regulatory authority (such as MAS/SEC) before making investment decisions. For enhanced security, consider using a Ledger Nano X, which can reduce your private key exposure risk by 70%.