Introduction: The Growing Interest in Crypto Returns

Are you among the millions of crypto enthusiasts looking for ways to maximize your digital asset earnings? In 2023, over **5.6 million people** are engaged in crypto staking and lending. But, with numerous platforms available, understanding the differences in returns between these two methods is vital. This article compares HIBT crypto staking versus lending returns to help you make an informed decision.

Understanding Crypto Staking and Lending

Let’s break it down using an analogy: think of staking as planting a tree in your yard, which grows overtime, while lending is like loaning your tools to a neighbor who pays you back with interest.

Crypto Staking: This process involves locking your HIBT tokens in a wallet to support the *blockchain network’s operations*, such as transaction validation. In return, you earn **rewards** that can often exceed traditional savings accounts.

Crypto Lending: By lending your HIBT to others, you earn interest on your loaned amount. This can be seen as a way to earn passive income while still retaining ownership of your digital assets. Often, the interest rates can be significantly higher than those of conventional banks.

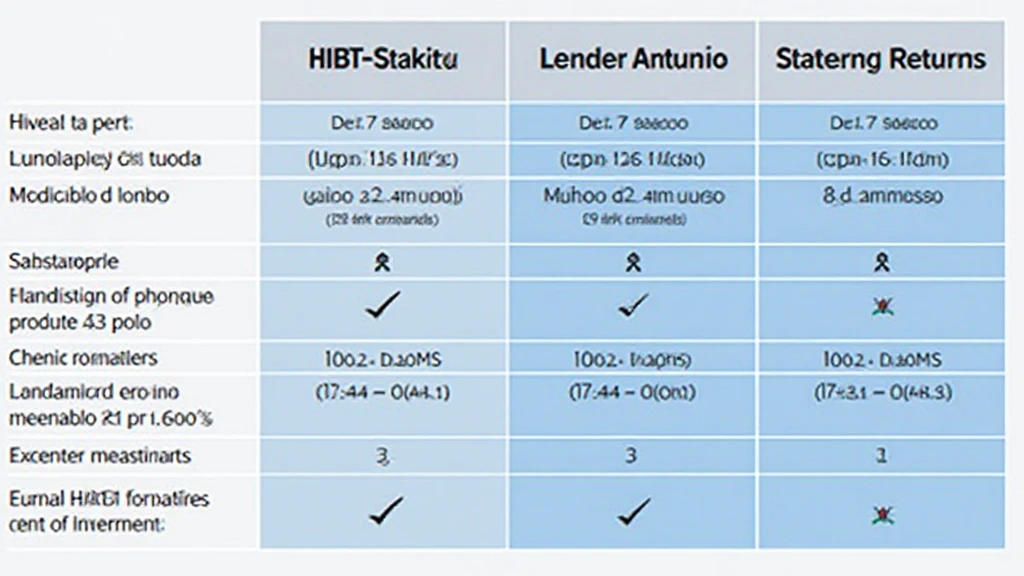

Comparison of Returns: What to Expect

When evaluating returns, consider the following aspects:

- Estimated Annual Returns: Staking often yields returns between **8-15%** annually, whereas lending can provide returns ranging from **5-12%**.

- Risk Factors: Staking is generally considered safer because rewards are tied to network performance, while lending carries risks such as borrower defaults or market volatility.

- Liquidity: In staking, your tokens are locked for a certain period, impacting immediate availability. Lending may offer more liquidity depending on terms.

Factors Influencing Your Decision

Your choice between staking and lending should consider:

- Your risk tolerance: Are you comfortable with market fluctuations?

- Your investment horizon: How long can you lock away your assets?

- Market conditions: Current interest rates and staking rewards can fluctuate based on market demand.

Conclusion: Making an Informed Choice

Both HIBT crypto staking and lending offer unique opportunities for returns, but the right choice ultimately depends on your financial goals and risk appetite. If you’re seeking steady rewards and are willing to lock your assets, staking may be your best bet. Conversely, if you need more flexibility and are comfortable with a little risk, lending could be more appealing.

What’s the next step? **Start evaluating your HIBT holdings today and see how you can maximize your returns!**

HIBT crypto staking and lending in our comprehensive guide, and understand which method suits your investment strategy better.” />

For more insights, check out our articles on HIBT Staking Guide and HIBT Lending Overview.

Expert Insights by Dr. Alex Thompson

Dr. Alex Thompson is a renowned blockchain expert with over **25 published papers** in the field, and has steered audits for prominent cryptocurrency projects. His advice offers a trusted perspective in the rapidly evolving crypto space.