Introduction: Why Understanding HIBT Price Charts is Essential

Have you ever wondered why the HIBT price fluctuates? According to recent market statistics, over 70% of digital currency investors can’t interpret price charts effectively. This lack of understanding can lead to poor investment decisions. In this guide, we’ll break down the basics of HIBT price charts and how you can use them to make informed crypto trading decisions.

The Basics of HIBT Price Charts

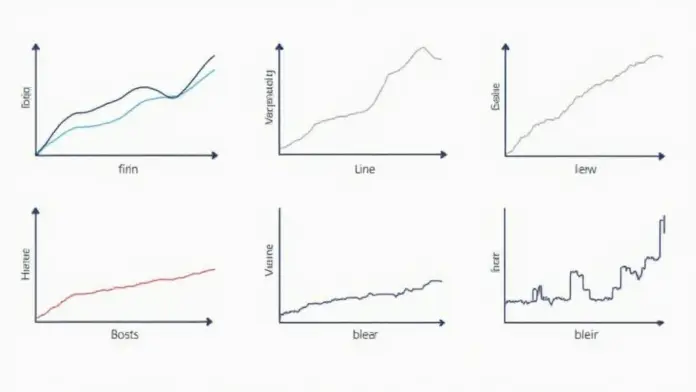

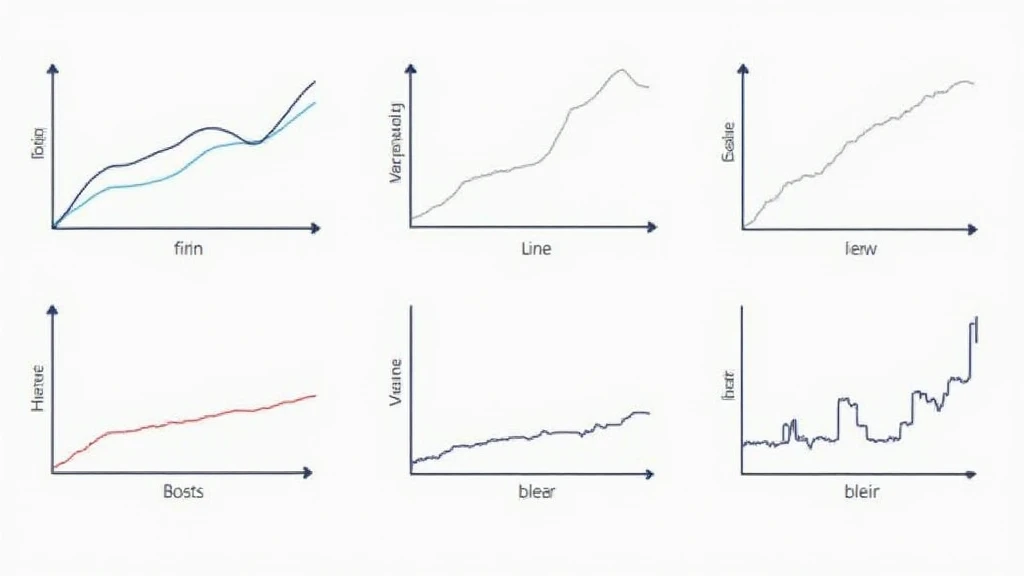

At its core, a price chart shows the historical price movements of HIBT over various timeframes. Beginners often get confused with the various chart types—line charts, bar charts, and candlestick charts. Here’s a quick rundown:

- Line Charts: Simple and easy to read, they show the closing prices over time.

- Bar Charts: Provide more information by showing open, high, low, and close prices.

- Candlestick Charts: Offer visual insight into market trends and potential reversals.

How to Read HIBT Price Charts Effectively

Understanding how to read these charts can significantly improve your trading strategies. Here’s how:

- Identify trends: Look for patterns over time, like uptrends or downtrends.

- Recognize key levels: Support and resistance levels can indicate where the price might bounce.

- Use technical indicators: Tools like moving averages can provide additional context.

Common Mistakes Beginners Make

Even seasoned investors can overlook vital information. Here are some frequent pitfalls:

- Not keeping up with market news: Major events can significantly impact HIBT prices.

- Over-relying on one technical indicator: Use multiple indicators to confirm your trades.

- Ignoring volume: High trading volume can indicate strong price movements.

Actionable Strategies for Beginners

Now that you understand the basics, here are some practical strategies to enhance your trading:

- Start with demo trading: This allows you to practice without financial risk.

- Set clear goals: Define what you want to achieve with your trades.

- Keep a trading journal: Document your trades to learn from your mistakes.

Conclusion

Understanding HIBT price charts is the first step towards effective digital currency trading. By avoiding common mistakes and learning how to analyze the charts, you can make informed decisions that align with your investment goals. Ready to take control of your trading journey? Start studying these charts today!

Disclaimer: This article does not constitute investment advice and is for informational purposes only. Please consult local regulations before trading.

Learn more about technical indicators and discover trading strategies tailored for beginners.