What Are HIBT DEX Liquidity Provider Fees?

Have you ever wondered how decentralized exchanges (DEXs) like HIBT work to ensure liquidity? The concept of liquidity provider fees is central to this. Essentially, these fees are what incentivize users to provide liquidity to the exchange. Think of it as a service charge for using your assets to facilitate trades between buyers and sellers. In this article, we’ll break down the significance of these fees, how they work, and what you need to know as a trader or investor in the crypto space.

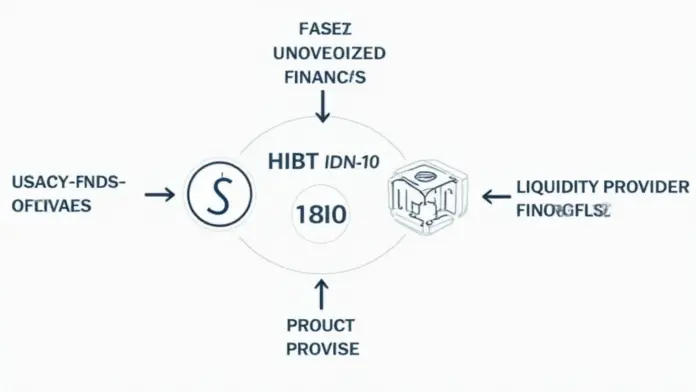

How Liquidity Works in Decentralized Exchanges

Let’s simplify this with an analogy. Imagine a bustling marketplace where vendors sell various goods. The more vendors there are, the more goods are available for buyers, and the better the prices can be. This is similar to how liquidity in a DEX works. By providing liquidity, you enable faster and cheaper transactions, ultimately benefiting the overall ecosystem.

The Composition of HIBT DEX Liquidity Provider Fees

When you add liquidity to the HIBT DEX, you might encounter:

- Trading Fees: A small percentage of each trade made on the platform.

- Incentives: Some platforms offer additional rewards in the form of their native tokens to attract liquidity providers.

- Withdrawal Fees: Fees applied when you withdraw funds from the liquidity pool.

Why are These Fees Important?

The liquidity provider fees are vital to sustaining the functionality of decentralized exchanges. Without these fees, liquidity providers might not be incentivized to lock their assets into a liquidity pool, which could lead to slippage and a less efficient trading experience. Moreover, they contribute towards the overall health of the DeFi ecosystem, allowing for a diverse range of trading pairs.

One might ask, “Can I maximize my returns?” Well, understanding these fees will definitely help you strategize better in your trading endeavors.

Best Practices for Engaging as a Liquidity Provider

If you’re new to providing liquidity, consider these effective strategies:

- Evaluate the risk vs. reward: Always understand the potential impermanent loss before committing your assets.

- Stay informed about market trends in your region, for example, Singapore’s crypto tax regulations

- Utilize analytics tools to track your liquidity provision performance.

With these insights, leveraging HIBT DEX liquidity provider fees can become an advantageous aspect of your trading strategy. Remember, success in the crypto space often lies in thorough research and continuous learning.

Conclusion

In summary, understanding HIBT DEX liquidity provider fees is essential for anyone looking to navigate the decentralized finance world. Whether you’re a seasoned trader or a curious newcomer, mastering these concepts will help you make informed decisions. Ready to enhance your trading experience? Dive into the world of HIBT DEX today!

Disclaimer: This article does not constitute investment advice. Please consult local regulatory authorities before investing.