Introduction

Did you know that over 300 million people globally now hold cryptocurrencies? Surprisingly, only a fraction understand the nuances between centralized finance (CeFi) and decentralized finance (DeFi). As of 2023, the total trading volume on CeFi platforms has significantly outpaced DeFi, raising questions about the future of digital currency trading.

What is CeFi?

Centralized Finance, or CeFi, operates under traditional banking systems, offering a more regulated environment. For example, platforms like Binance and Coinbase manage users’ funds and transactions through centralized order books. But what does this mean for you?

- Ease of Use: Generally, CeFi platforms are simpler and more user-friendly. Even a novice can start trading within minutes.

- Larger Volume: CeFi exchanges handle more extensive trading volumes, as they attract institutional investors.

Understanding DeFi

On the other hand, Decentralized Finance (DeFi) eliminates intermediaries, allowing users to trade directly through smart contracts on blockchain networks. Think of it as a farmer’s market where you engage directly with the producers.

- Autonomy: Investors retain full control over their assets.

- Potential for Innovation: DeFi enables unique financial products, such as yield farming and liquidity pools.

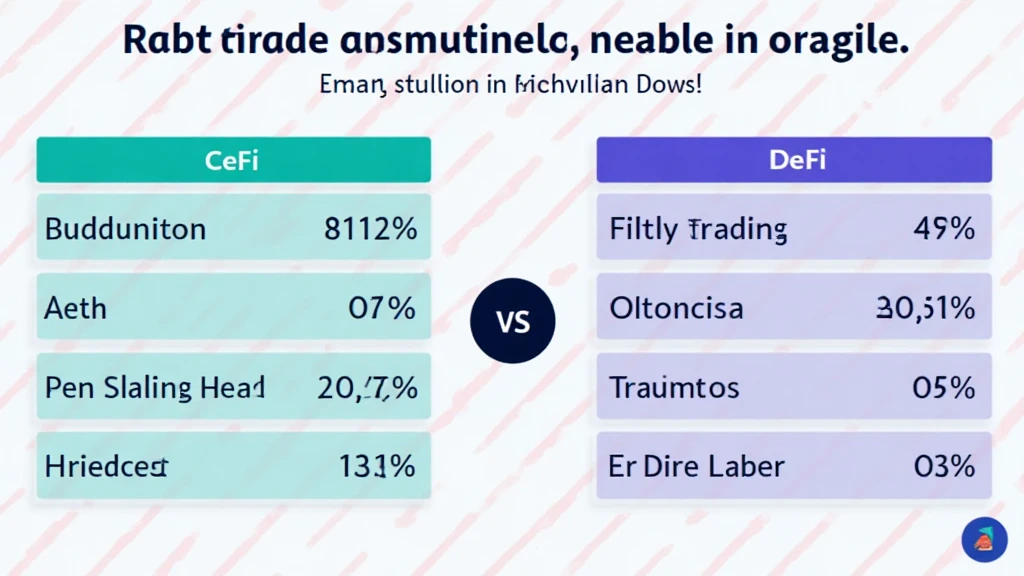

Comparing Trading Stats: CeFi vs DeFi

According to recent reports, CeFi currently holds about 70% of the market share for cryptocurrency trading, while DeFi is comfortably settling at around 30%. But what drives these figures?

- Liquidity: CeFi platforms tend to have higher liquidity, making it easier to execute large trades without significant price shifts.

- Security Concerns: While CeFi offers regulations, DeFi faces risks due to smart contract vulnerabilities.

The Future of Trading: What to Expect?

The future of trading will likely involve a hybrid approach, leveraging the strengths of both CeFi and DeFi systems. Industry experts predict a convergence where traditional financial systems will integrate blockchain technology.

- More interoperability between CeFi and DeFi platforms.

- Increased regulatory clarity, particularly in regions like Singapore and Europe.

- Emergence of stablecoins that bridge the gap between fiat currencies and cryptocurrencies.

Conclusion

In summary, understanding the differences between CeFi and DeFi trading is crucial for today’s investors. As the landscape evolves, staying informed about trends and statistics will empower you to make informed investment decisions. Ready to dive deeper into the world of cryptocurrencies? Check out our other articles at hibt.com!