Introduction: Are You Ready to Maximize Your Trading Strategy?

With over 5.6 billion cryptocurrency holders globally, only 23% understand the various trading options available to them. This knowledge gap can hinder your ability to maximize profits in the fast-paced world of digital currencies. Have you ever wondered what the best order types are and how they can shape your trading success?

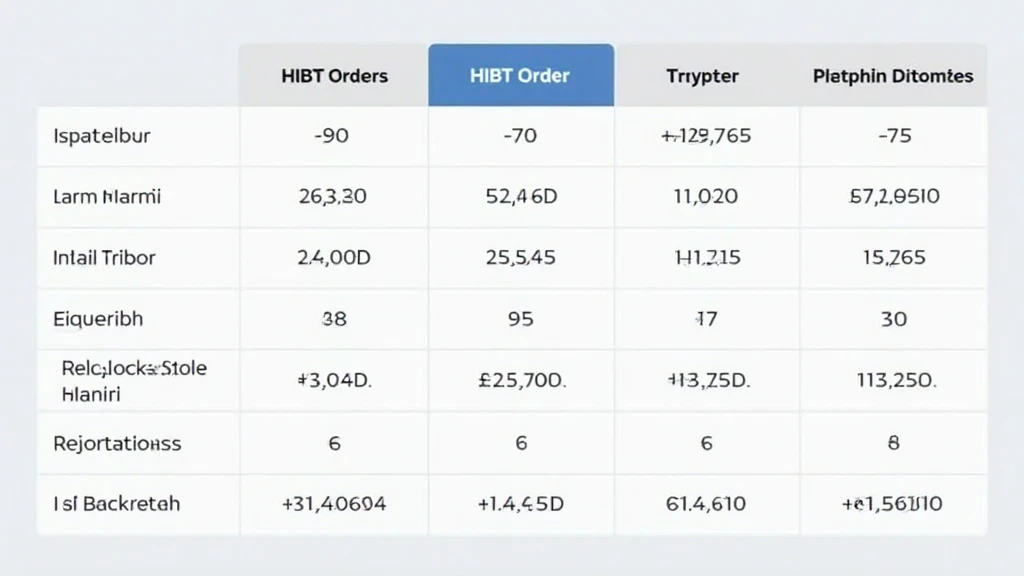

Understanding HIBT Order Types

The HIBT (High-Impact Bitcoin Trading) platform offers multiple order types that can cater to various trading strategies. Here’s a quick breakdown:

- Market Orders: Execute at the current market price. Ideal for quick trades but can lead to slippage.

- Limit Orders: Set your buying/selling price ahead of time. Useful for ensuring price control but may not execute immediately.

- Stop-Loss Orders: Automatically sell once a set price is reached. Great for minimizing losses but may trigger on price fluctuations.

- Take-Profit Orders: Lock in profits at a certain price level. Allows for strategic exits, securing your gains.

Why Use a Comparison Chart?

A comparison chart can visually simplify your choices, helping you spot the right order types for your needs. By analyzing key aspects like execution speed, risk, and cost, you can make informed decisions that suit your trading style.

How to Choose the Right Order Type

Choosing the appropriate order type is critical. Here’s a mini-guide:

- Are you a risk-averse trader? Consider Stop-Loss or Take-Profit orders.

- Do you need to act fast? Market Orders might be your best option.

- Want control over your prices? Use Limit Orders.

Understanding these options allows you to adapt to market conditions more effectively.

Conclusion: Take Control of Your Trading Today!

Armed with the knowledge of HIBT order types, it’s time to enhance your trading strategy. Download our free HIBT order types comparison chart today to start optimizing your trading outcomes. Remember, knowledge is power in the crypto world!

This article does not constitute investment advice. Always consult local regulatory agencies before making trading decisions.