Introduction: Why HIBT TWAP Algorithms Matter in Crypto Trading

Did you know that over 56% of institutional investors are now integrating automated trading strategies in the digital currency market? In an era where blockchain technology shapes the financial landscape, understanding execution algorithms like HIBT TWAP (Time-Weighted Average Price) is crucial for maximizing profits and minimizing risks. But what exactly does this mean for your trading practices?

What is HIBT TWAP?

The HIBT TWAP algorithm is designed to execute large orders evenly across a specified timeframe, essentially executing trades at average prices within that period. Think of it like a seasoned chef managing a busy kitchen; just as a chef spreads out tasks to avoid chaos, the HIBT TWAP algorithm helps to mitigate market impact and avoid drastic price changes during large trades.

- Key Benefits: Reduces slippage and improves execution efficiency.

- Risk Management: Minimizes the risks associated with volatility in digital asset prices.

- Market Integration: Works seamlessly with blockchain applications to ensure transparency and reliability.

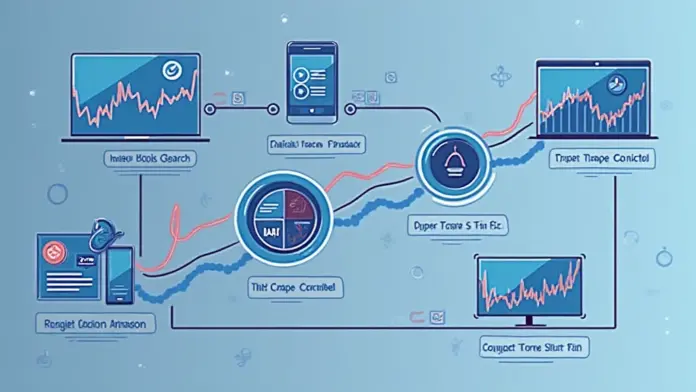

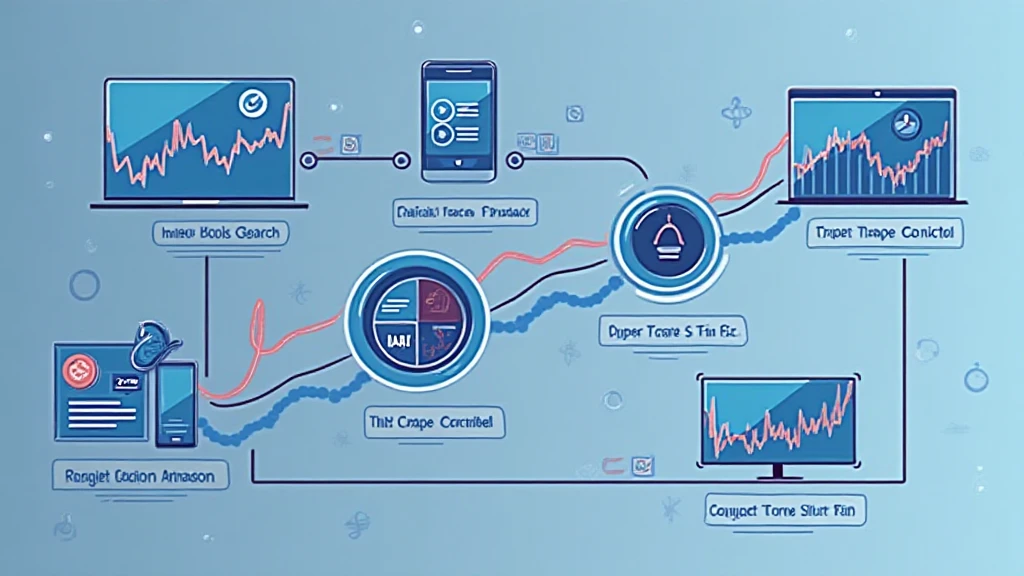

How Does HIBT TWAP Work in Practice?

Imagine you’re at a farmer’s market, trying to buy a significant amount of strawberries. If you buy all at once, the prices may skyrocket due to your demand. However, if you buy a little at a time, you secure better prices. This analogy mirrors how HIBT TWAP operates:

- Order Splitting: The algorithm divides a large order into smaller segments.

- Scheduled Execution: It executes at predefined intervals, continually checking the market price.

- Dynamic Adjustments: Adjusts based on real-time market conditions to obtain the best average price.

Real-World Applications of HIBT TWAP

In 2025, experts predict that the Asia-Pacific region will see a 40% increase in digital currency trading volumes, making effective execution strategies more critical than ever. Institutions and traders can harness HIBT TWAP algorithms to:

- Avoid Market Manipulation: By executing over time, larger players mitigate the risk of price manipulation.

- Enhance Liquidity: It encourages smoother transitions in trading flows, fostering better liquidity.

- Facilitate Larger Transactions: Larger investments become less daunting with effective execution strategies like HIBT TWAP.

Conclusion: Elevate Your Trading with HIBT TWAP

In a fast-evolving digital landscape, understanding and utilizing execution algorithms like HIBT TWAP is essential for traders looking to optimize transactions. Just like a seasoned trader carefully navigates the market, implementing such strategies can significantly enhance trading success. Want to dive deeper into blockchain technology for digital asset management? Explore more insights on our platform!

Disclaimer: This article does not constitute investment advice. Always consult with local regulatory bodies before engaging in trading practices.

Explore more related topics on our site: Blockchain Basics or Execution Strategies.