Introduction: The Need for Tokenization

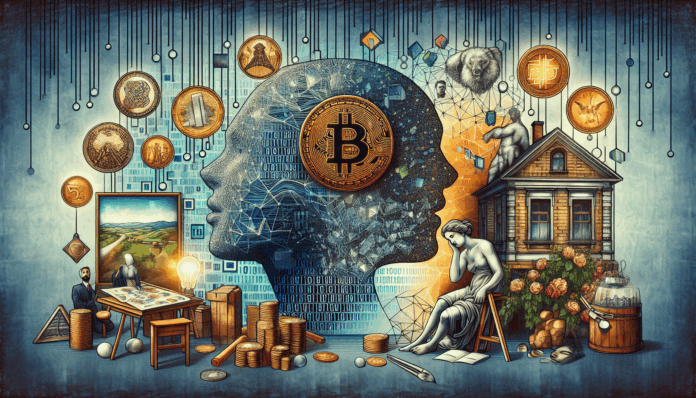

Did you know that as of 2022, $1.7 trillion worth of assets could be tokenized on blockchain networks? With more than 5.6 billion people participating in the global economy, the process of tokenizing real-world assets is becoming not just a trend, but a necessity.

What is Asset Tokenization?

Tokenization refers to the process of converting rights to an asset into a digital token on the blockchain. This process allows for easier, faster, and more secure transactions. Think of it as a way to turn your grandmother’s antique vase into a digital token. By doing so, anyone can buy a fraction of that vase without actually possessing it.

The Benefits of Tokenization

- Increased Liquidity: By dividing assets into smaller tokens, investors can buy, sell, or trade fractions of the asset, thereby improving liquidity.

- Reduced Costs: Traditional asset management involves a multitude of intermediaries. Tokenization eliminates many of these, reducing transaction costs significantly.

- Enhanced Security: Utilizing blockchain technology ensures that asset ownership is recorded transparently and securely.

- Fractional Ownership: Tokenization allows for broader access to investments, as individuals can purchase smaller portions of expensive assets.

Real-World Examples of Tokenization

You might wonder, how is this playing out in the real world? Here are a few examples:

- A luxury real estate firm has tokenized properties, allowing investors to own a share of high-end real estate for a fraction of the price.

- Artworks from renowned artists are being tokenized, enabling art enthusiasts to own and trade fractions of masterpieces.

Challenges and Considerations

While the potential is impressive, there are challenges to be aware of:

- Regulatory Compliance: Each country has different regulations governing asset tokenization.

- Consumer Awareness: Many people still misunderstand how tokenization works, leading to skepticism.

Conclusion: The Future of Tokenizing Real-World Assets

Tokenizing real-world assets presents a compelling case for the digital economy. By leveraging blockchain technology principles, it promises to make investing more accessible, equitable, and efficient. Join us in embracing this innovative trend and explore how you can be part of this transformative movement in the digital space.

Take Action: Download our comprehensive guide on how to effectively invest in tokenized assets and stay ahead of the digital currency curve!

Meta Description: Discover why tokenizing real-world assets is essential for a seamless digital economy. Learn about the benefits, challenges, and future prospects of this innovative trend.

For more insights on digital currency trading and blockchain technology principles, check our other articles on HIBT. As reported by various industry analysts, tokenization is set to redefine asset ownership and investment in the years ahead.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a local regulatory body before making investment decisions.