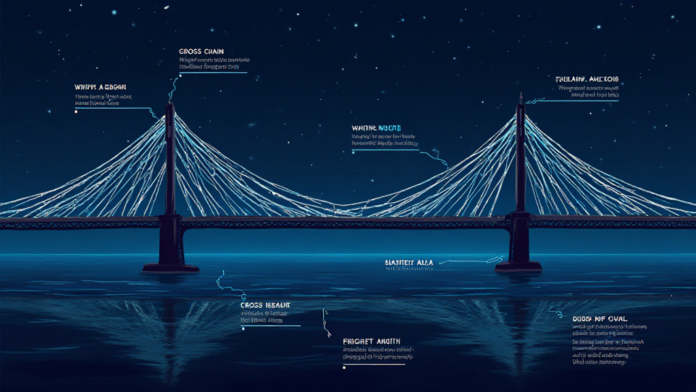

Understanding Cross-Chain Bridges

Imagine a currency exchange booth where you can trade dollars for euros. Cross-chain bridges function similarly, allowing users to transfer assets between different blockchain networks. However, as highlighted by Chainalysis data from 2025, a staggering 73% of these bridges have vulnerabilities that hackers could exploit. This raises serious concerns for investors and regulators alike.

The Importance of Interoperability

The rise of DeFi (Decentralized Finance) is like a new shopping mall opening up within a city—each store represents a different blockchain with its unique offerings. For these stores to succeed, they need customers from all over the city. This is where interoperability through cross-chain solutions becomes crucial. However, ensuring these links are secure is vital for maintaining trust in the ecosystem.

Zero-Knowledge Proof Applications

Consider zero-knowledge proofs as a way to verify your age when buying alcohol without revealing your birth date. By utilizing this method, blockchains can enhance privacy while ensuring transactions are valid. As we look towards 2025, the integration of zero-knowledge proofs in cross-chain operations could significantly reduce fraud and increase user confidence.

2025 Singapore DeFi Regulation Trends

Singapore is becoming a beacon for crypto regulations, much like a lighthouse guiding ships safely to shore. By 2025, we anticipate more robust frameworks that could shape the global DeFi landscape. These regulations will provide clearer guidelines for businesses and help protect investors from potential scams.

In summary, understanding the dynamics of cross-chain technology and its associated risks will be critical for stakeholders in the crypto space. As technology continues to advance, staying informed will empower users to navigate this evolving market safely. For further insights, download our toolkit on secure blockchain practices today!