2025 Ethereum Gas Predictors and Market Insights

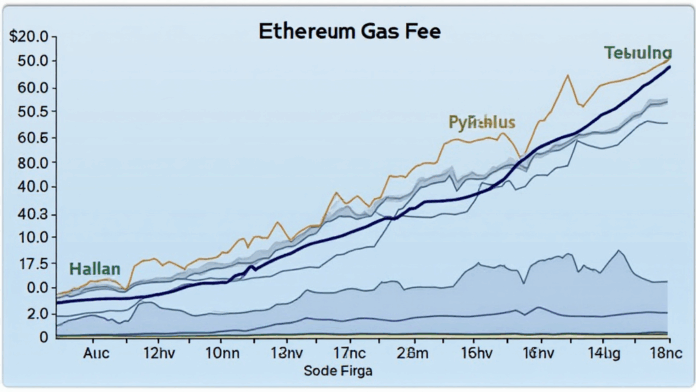

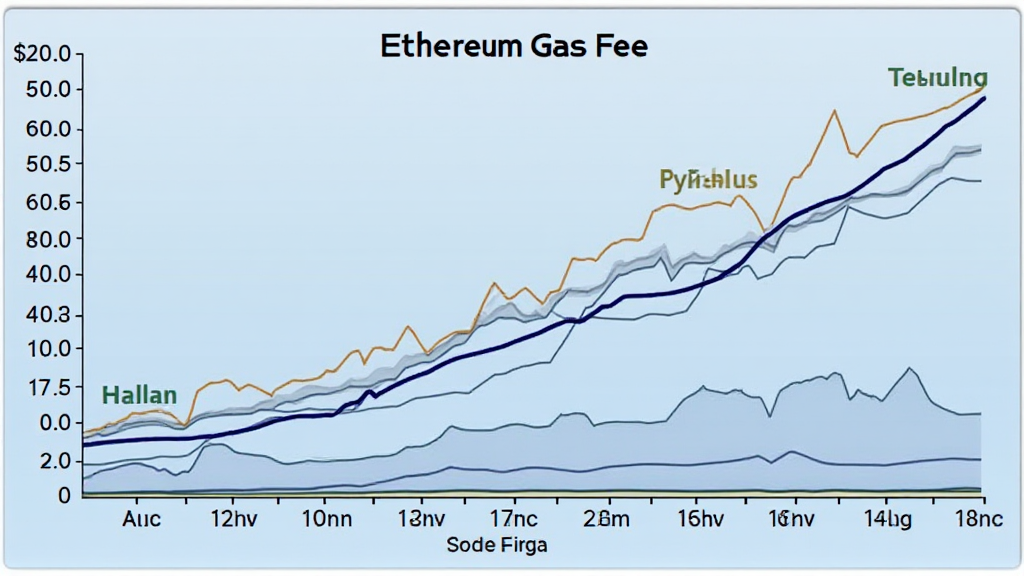

As we step into an evolving landscape of decentralized finance (DeFi), the importance of understanding Ethereum gas predictors cannot be overstated. According to Chainalysis data for 2025, a staggering 73% of transactions on the Ethereum network face gas fees that fluctuate unpredictably, impacting the profitability of trading strategies.

What Are Ethereum Gas Predictors?

Think of Ethereum gas predictors as weather forecasts for your transactions. Just like checking the weather to decide if you need an umbrella, gas predictors help you gauge the best time to make a trade while minimizing costs. By analyzing historical gas fee data and real-time metrics, these tools guide traders to optimize their operations.

How Are Gas Fees Calculated?

Understanding gas fees is essential for any Ethereum trader. Imagine a bustling marketplace where vendors charge different prices for their goods at different times. Transaction costs on Ethereum are similarly variable, influenced by network demand. Factors such as transaction size and time of day can all play a role in the final fee you pay.

The Role of Cross-Chain Interoperability

Cross-chain interoperability can be likened to using different currencies when shopping abroad. It enables seamless asset transfers across various blockchains, potentially helping users avoid high Ethereum gas fees. By opting for alternative networks during peak times, traders can save on costs while still accessing the benefits of decentralized finance.

Zero-Knowledge Proofs and Their Impact on Costs

Zero-knowledge proofs might sound complicated, but think of them like a secret handshake that confirms your identity without revealing personal details. In the crypto world, they enhance privacy and scalability, leading to reduced transaction fees. As more protocols adopt these proofs, we might see a significant drop in Ethereum’s gas fees moving into 2025.

In summary, leveraging Ethereum gas predictors, understanding the dynamics of gas fee calculations, and exploring technologies like zero-knowledge proofs can empower traders on their investment journeys. To further enhance your trading efficacy, download our essential toolkit that provides insights tailored for 2025.

For more information on cross-chain security audits, check out our security white paper. Remember, the crypto landscape is ever-changing, so stay informed!

Disclaimer: This article does not constitute financial advice. Always consult with your local regulatory authority, like the MAS or SEC, before making any investment decisions. Tools like the Ledger Nano X can reduce your risk of private key exposure by up to 70%.

Author: Dr. Elena Thorne

Former IMF Blockchain Advisor | ISO/TC 307 Standard Developer | Authored 17 IEEE Blockchain Papers