Understanding Ethereum DeFi Platforms: 2025 Trends and Challenges

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges have vulnerabilities. This statistic underscores the urgent necessity for users and investors to understand the landscape of Ethereum DeFi platforms and how they fit into the broader financial technology market.

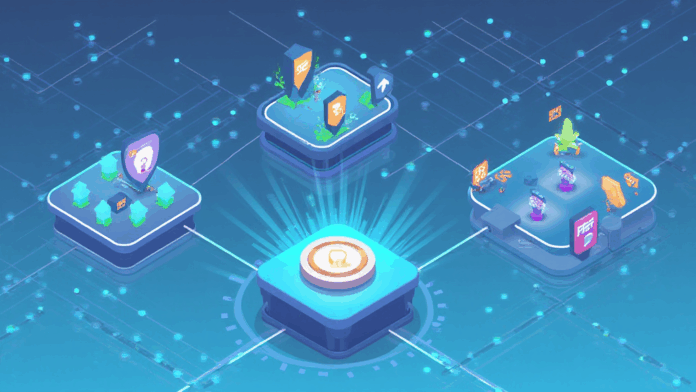

How Do Cross-Chain Interoperability Solutions Work?

Imagine you are at a currency exchange booth in a busy market. You have euros but need dollars to buy local goods. Cross-chain bridges operate similarly, allowing transactions between different blockchains. They facilitate smoother exchanges within the DeFi ecosystem, much like how currency exchange kiosks help tourists. However, just like these booths can have discrepancies, cross-chain solutions also come with risks, leading to vulnerabilities that hackers often exploit, as seen in many high-profile breaches.

What Are Zero-Knowledge Proof Applications?

Picture a sealed envelope that contains a secret; only you and your friend know what’s inside. Zero-knowledge proofs work on the same principle, enabling verification of information without disclosing the data itself. Within Ethereum DeFi platforms, this technology guarantees user privacy, enhancing security and trust in transactions. As regulatory scrutiny increases, zero-knowledge proofs might play a pivotal role in maintaining confidentiality while complying with regulations.

What to Expect from DeFi Regulations in Singapore by 2025?

As Singapore gears up to embrace the DeFi wave, regulatory clarity is paramount. The Monetary Authority of Singapore (MAS) plans to introduce frameworks that will support innovation while protecting investors. For instance, could new regulations help standardize practices among Ethereum DeFi platforms? Expect a balanced approach that encourages growth while ensuring investor safety.

How Does PoS Mechanism Energy Consumption Compare?

The transition from Proof of Work (PoW) to Proof of Stake (PoS) can be likened to switching from a gas-powered car to an electric vehicle. It’s generally better for the environment, leading to reduced energy costs. In 2023, Ethereum’s shift to PoS resulted in a reported 99.95% reduction in energy consumption. Understanding this impact on Ethereum DeFi platforms and their sustainability is crucial for environmentally-conscious investors.

In conclusion, staying informed about the evolving Ethereum DeFi platforms landscape is essential for navigating potential risks and opportunities. If you’d like more insights, download our comprehensive toolkit today!

Meta Description: Discover how Ethereum DeFi platforms tackle vulnerability issues with cross-chain interoperability and zero-knowledge proof applications. Stay ahead in 2025!

For further reading, check out our cross-chain security white paper and learn more about DeFi trends in 2025. Also, don’t forget to visit our cryptocurrency tax guide for Dubai.

Risk Disclaimer: This article does not constitute investment advice. Consult with local regulatory bodies, such as MAS or SEC, before making any financial decisions.

Implementing a hardware wallet like Ledger Nano X can significantly reduce your risk of private key exposure by up to 70%.