Understanding Cross-Chain Bridges: What Are They?

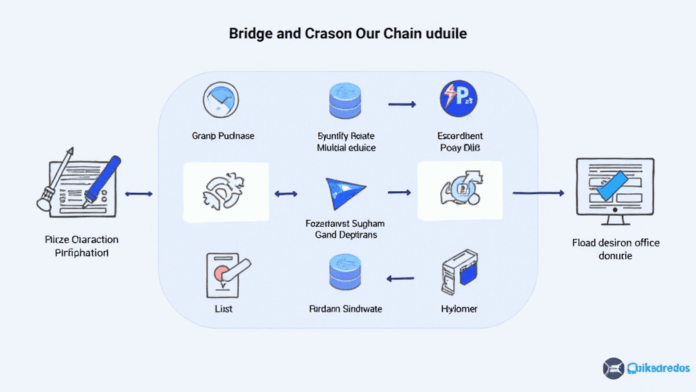

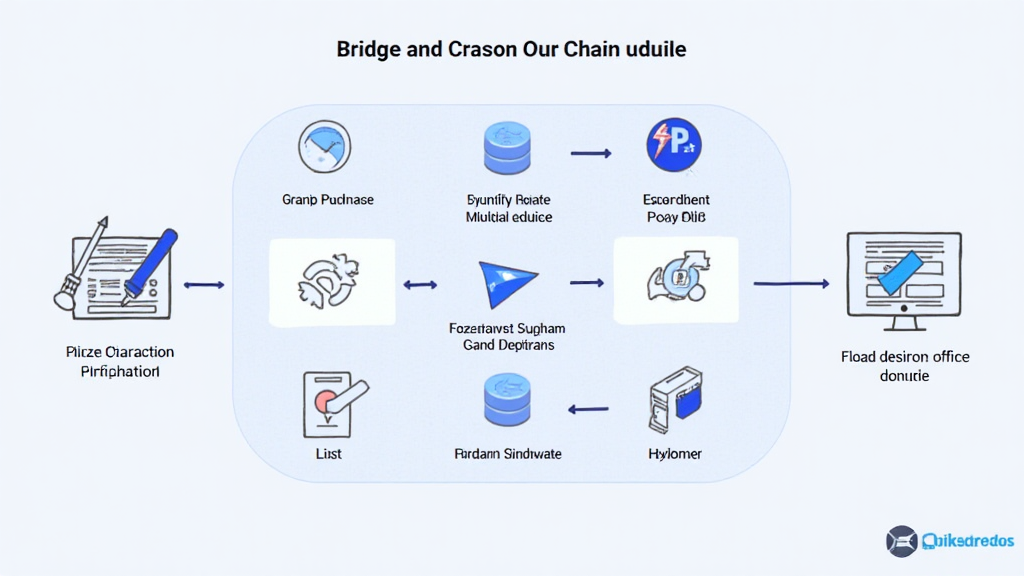

Imagine you’re at a market and you want to exchange currency. A cross-chain bridge operates like a currency exchange booth, allowing you to swap assets between different blockchains. According to Chainalysis data from 2025, an alarming 73% of cross-chain bridges have vulnerabilities that can be exploited, making them a target for hackers.

The Importance of HIBT Order Execution in Secure Transactions

HIBT order execution ensures that transactions across various chains occur smoothly and securely. This process is crucial in reducing the risk of double spends and ensuring that your assets reach their intended destination safely. Think of it this way: it’s like having a trusted friend confirm your currency exchange – it creates an extra layer of trust in a potentially risky transaction.

Potential Risks and How to Mitigate Them

When engaging with cross-chain bridges, one must consider risks such as smart contract vulnerabilities and network congestion. Using secure wallets, like the Ledger Nano X, can reduce the risk of private key exposure by up to 70%, offering peace of mind. Just like protecting your cash in a safe, securing your digital assets is vital.

Future of Cross-Chain Technology and Regulation

As the world moves toward more decentralized finance (DeFi), regulations will evolve. For instance, Singapore’s 2025 DeFi regulation trends indicate a robust framework for ensuring the safety of innovative financial products. This regulatory landscape will be crucial for fostering trust and encouraging adoption of technologies, including HIBT order execution protocols.

In conclusion, understanding the mechanics of cross-chain bridges and the importance of HIBT order execution is essential for anyone looking to navigate the crypto landscape safely. For more information and to download our comprehensive toolkit on cross-chain security, visit hibt.com.