Understanding HIBT AML / KYC Procedures in 2025

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges continue to possess vulnerabilities that put investors at risk. With the rise of decentralized finance (DeFi), understanding HIBT AML / KYC procedures has never been more crucial.

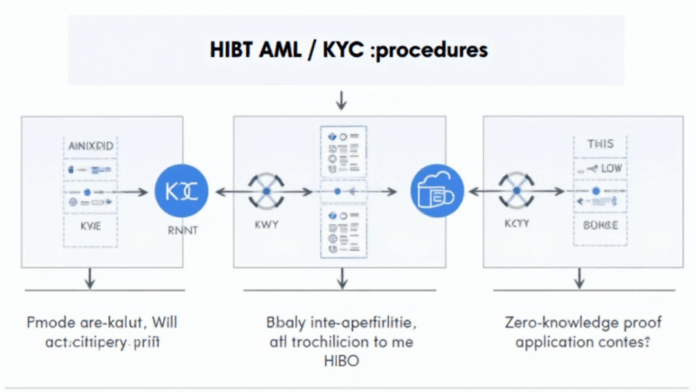

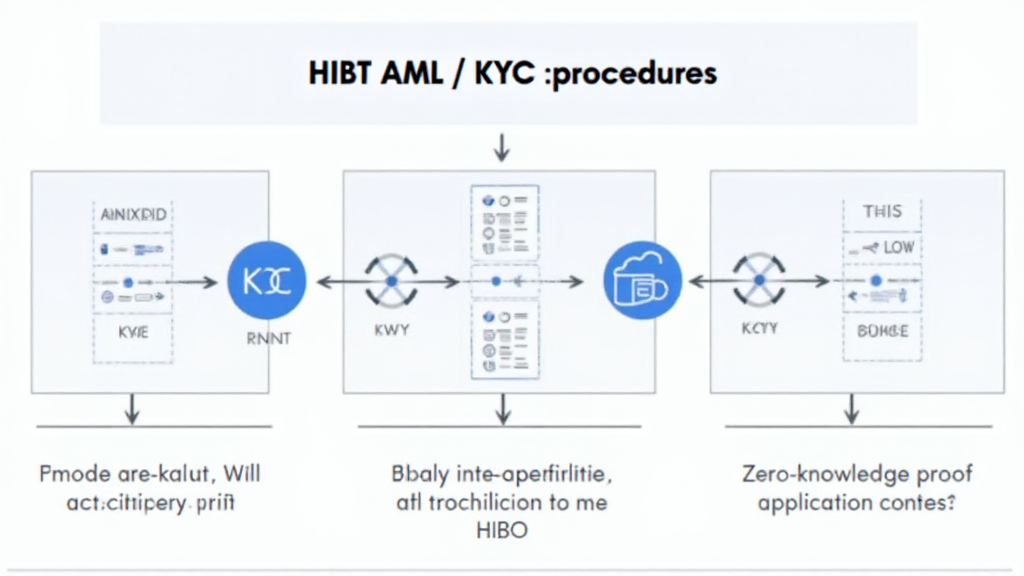

1. What Are HIBT AML / KYC Procedures?

Imagine visiting a currency exchange booth at a bustling marketplace. You wouldn’t exchange money without verifying that it’s legitimate, right? This concept is the essence of HIBT AML (Anti-Money Laundering) and KYC (Know Your Customer) procedures. They ensure that financial transactions are traced to reputable sources, thereby preventing illegal activities.

2. Why Are HIBT AML / KYC Procedures Important for Cross-Chain Transactions?

Cross-chain interoperability allows different blockchain systems to communicate — like a translator in a multi-language marketplace. However, without stringent HIBT AML / KYC procedures, these translations can lead to financial mishaps. Implementing effective verification processes can safeguard against fraud, making the ecosystem more secure.

3. The Role of Zero-Knowledge Proofs in Enhancing Compliance

Think about zero-knowledge proofs like a recipe that proves you made a delicious dish without revealing its secret ingredients. In finance, these proofs can verify a transaction’s legitimacy while keeping sensitive data hidden, allowing platforms to comply with HIBT AML / KYC requirements without compromising user privacy.

4. Future Trends of HIBT AML / KYC in 2025

As we look towards 2025, the landscape of regulatory compliance within the DeFi sector is evolving rapidly. Markets like Dubai are starting to implement tailored crypto tax guidelines. As these regulations develop, understanding the continual changes in HIBT AML / KYC procedures becomes essential for traders and developers alike.

In conclusion, comprehending HIBT AML / KYC procedures is vital for ensuring a secure and reliable trading environment. To stay updated, download our toolkit and navigate the evolving landscape with confidence!

Download our comprehensive toolkit here!

Check out our cross-chain security whitepaper for deeper insights.

Learn more about compliance measures and their importance.

Explore solutions for securing your assets.

Disclaimer: This article is not intended as investment advice. Consult with local regulatory bodies like MAS or SEC before proceeding.

As a final note, utilizing hardware wallets like Ledger Nano X could reduce the risk of private key leakage by up to 70%.

By VirtualCurrencyBitcoin