2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis, by 2025, a staggering 73% of cross-chain bridges are expected to possess vulnerabilities, jeopardizing the funds of countless crypto investors. With HIBT security infrastructure paving the way towards safer financial ecosystems, it’s vital to understand what this means for the future of decentralized finance (DeFi).

Understanding Cross-Chain Bridges

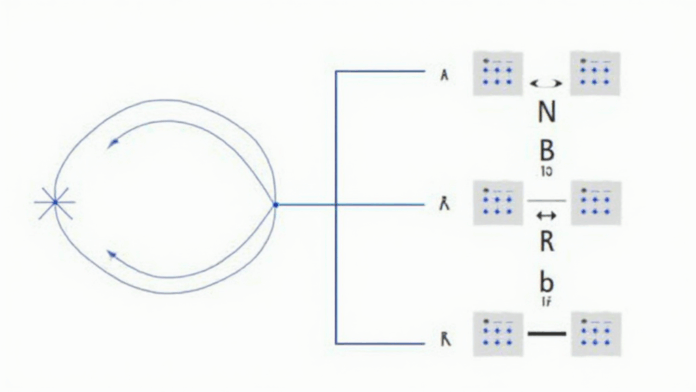

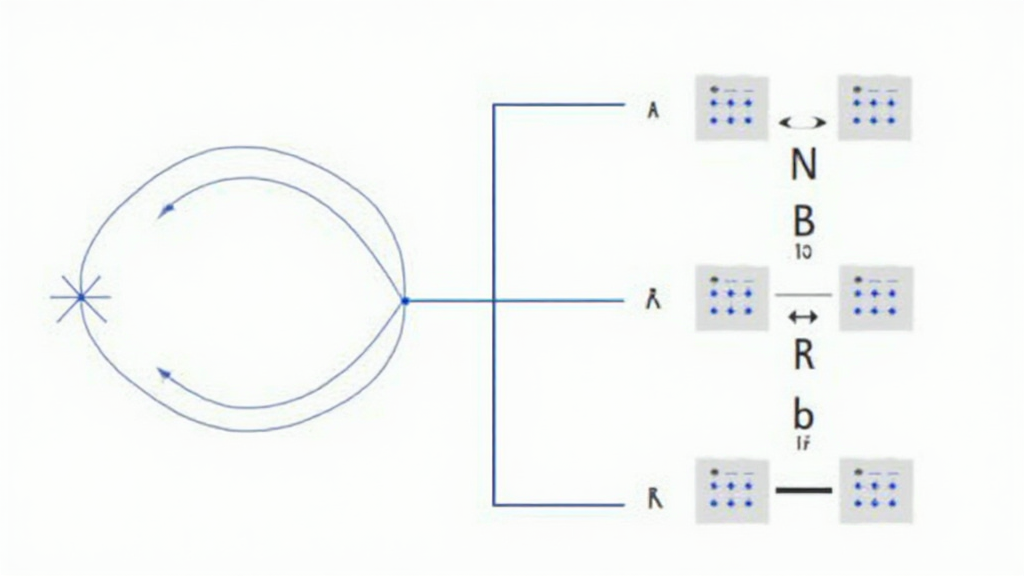

Imagine walking into a currency exchange shop at the airport. You need to swap your dollars for euros quickly because your flight is boarding. Cross-chain bridges function similarly—they provide a means to transfer assets between different blockchain ecosystems. However, just like currency shops can be mismanaged or hacked, so too can these bridges. The inherent vulnerabilities present risks that can be mitigated through effective HIBT security infrastructure.

The Role of Zero-Knowledge Proofs in Enhancing Security

You might have heard about zero-knowledge proofs making waves in cybersecurity. Picture a scenario where you want to prove to your friend that you have a valid concert ticket without actually showing them your ticket details. That’s what zero-knowledge proofs do—they allow one party to prove information to another without revealing the information itself. This technology is pivotal in the HIBT security infrastructure, helping to improve the integrity of cross-chain transactions.

Environmental Impact Comparison of PoS Mechanism

If you’ve considered switching your energy provider to save costs, you’ll understand the PoS (Proof of Stake) mechanism comparison. Just as choosing an energy supplier can have wide impacts on your monthly bills and the environment, the PoS mechanism impacts not just operational costs but also energy consumption drastically less than its PoW (Proof of Work) counterpart. Understanding how these two mechanisms can converge within HIBT security infrastructure is crucial for sustainable DeFi growth.

Regulatory Trends in 2025 for Singapore’s DeFi

Let’s say you’re planning a trip to Singapore; you’d need to know the local tax guidelines to avoid fines. The same goes for the evolving DeFi landscape there. The 2025 outlook predicts stricter regulations to help secure investors involved in DeFi initiatives. With the HIBT security infrastructure in place, companies can ensure compliance while providing safer platforms for users.

In conclusion, leveraging HIBT security infrastructure is essential for strengthening security in decentralized finance. As vulnerabilities in cross-chain bridges are alarming, staying informed about technological advancements such as zero-knowledge proofs and regulatory trends will empower investors and developers alike. Download our comprehensive toolkit to learn more about these critical insights.