2025 Cross-Chain Security Audit Guide: HIBT Digital Signature Protocols

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges show vulnerabilities. With the rapid rise of decentralized finance (DeFi) and cryptocurrencies, understanding the implications of HIBT digital signature protocols is more important than ever.

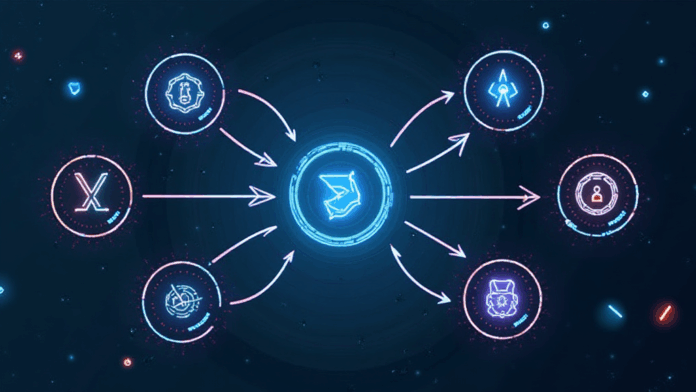

Understanding Cross-Chain Interoperability

Imagine you’re at a currency exchange booth while traveling. Just like you need to show your ID when exchanging money, cross-chain interoperability allows different blockchain networks to verify transactions using digital signatures. HIBT digital signature protocols play a vital role in ensuring these transactions maintain their integrity.

Zero-Knowledge Proof Applications Explained

Let’s say you want to prove to a friend that you have a certain amount of money without showing your entire bank statement. That’s what zero-knowledge proofs do! They let you validate information without revealing the actual data. This concept is essential in enhancing user privacy and security in blockchain transactions.

2025 Trends in Singapore’s DeFi Regulation

You might have heard that Singapore is ahead in the DeFi regulatory game. By 2025, local regulations will demand tighter security protocols, including the adoption of HIBT digital signature protocols. This ensures that as DeFi grows, consumers remain protected against vulnerabilities and fraud.

Comparing PoS Mechanism Energy Consumption

If you think of blockchains as cities, PoS (Proof of Stake) mechanisms act as the traffic lights that manage the flow of transactions efficiently and sustainably. However, different blockchains have unique energy profiles, which impacts their eco-friendliness. HIBT digital signature protocols can help optimize energy usage in these processes.

In conclusion, understanding HIBT digital signature protocols is crucial for navigating the evolving landscape of cryptocurrencies and ensuring transaction security. Download our toolkit to explore these technologies further and safeguard your digital assets.

For more insights, visit our resources on cross-chain security or digital signatures today.

Disclaimer: This article does not constitute investment advice. Always consult with local regulatory authorities (e.g., MAS/SEC) before proceeding with any financial decisions.

Risk Mitigation: Using Ledger Nano X can reduce private key exposure risks by up to 70%.